Page 37 - Hong Kong Productivity Council Independent Auditor’s Report and Financial Statements 2024-25

P. 37

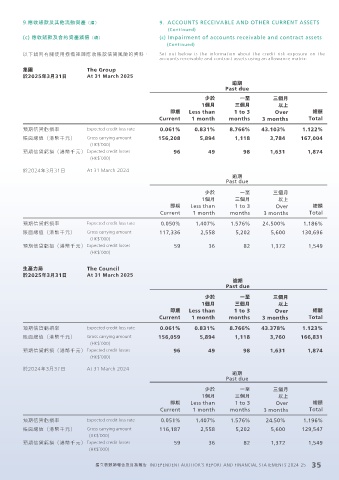

9.應收賬款及其他流動資產(續) 9. ACCOUNTS RECEIVABLE AND OTHER CURRENT ASSETS

(Continued)

(c) 應收賬款及合約資產減值(續) (c) Impairment of accounts receivable and contract assets

(Continued)

9. ACCOUNTS RECEIVABLE AND OTHER CURRENT ASSETS 以下載列有關使用撥備矩陣應收賬款信貸風險的資料: Set out below is the information about the credit risk exposure on the

(Continued) accounts receivable and contract assets using an allowance matrix:

集團 The Group

於2025年3月31日 At 31 March 2025

逾期

Past due

少於 一至 三個月

1個月 三個月 以上

即期 Less than 1 to 3 Over 總額

Current 1 month months 3 months Total

預期信貸虧損率 Expected credit loss rate 0.061% 0.831% 8.766% 43.103% 1.122%

賬面總值(港幣千元) Gross carrying amount 156,208 5,894 1,118 3,784 167,004

(HK$’000)

預期信貸虧損(港幣千元) Expected credit losses 96 49 98 1,631 1,874

(HK$’000)

於2024年3月31日 At 31 March 2024

逾期

Past due

少於 一至 三個月

1個月 三個月 以上

即期 Less than 1 to 3 Over 總額

Current 1 month months 3 months Total

預期信貸虧損率 Expected credit loss rate 0.050% 1.407% 1.576% 24.500% 1.186%

賬面總值(港幣千元) Gross carrying amount 117,336 2,558 5,202 5,600 130,696

(HK$’000)

預期信貸虧損(港幣千元) Expected credit losses 59 36 82 1,372 1,549

(HK$’000)

生產力局 The Council

於2025年3月31日 At 31 March 2025

逾期

Past due

少於 一至 三個月

1個月 三個月 以上

即期 Less than 1 to 3 Over 總額

Current 1 month months 3 months Total

預期信貸虧損率 Expected credit loss rate 0.061% 0.831% 8.766% 43.378% 1.123%

賬面總值(港幣千元) Gross carrying amount 156,059 5,894 1,118 3,760 166,831

(HK$’000)

預期信貸虧損(港幣千元) Expected credit losses 96 49 98 1,631 1,874

(HK$’000)

於2024年3月31日 At 31 March 2024

逾期

Past due

少於 一至 三個月

1個月 三個月 以上

即期 Less than 1 to 3 Over 總額

Current 1 month months 3 months Total

預期信貸虧損率 Expected credit loss rate 0.051% 1.407% 1.576% 24.50% 1.196%

賬面總值(港幣千元) Gross carrying amount 116,187 2,558 5,202 5,600 129,547

(HK$’000)

預期信貸虧損(港幣千元) Expected credit losses 59 36 82 1,372 1,549

(HK$’000)

獨立核數師報告及財務報告 INDEPENDENT AUDITOR’S REPORT AND FINANCIAL STATEMENTS 2024-25 35