Page 50 - Hong Kong Productivity Council Independent Auditor’s Report and Financial Statements 2024-25

P. 50

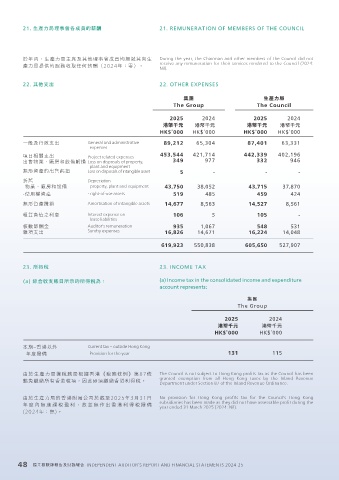

21. 生產力局理事會各成員的薪酬 21. REMUNERATION OF MEMBERS OF THE COUNCIL

於年內,生產力局主席及其他理事會成員均無就其向生 During the year, the Chairman and other members of the Council did not

產力局提供的服務收取任何薪酬(2024年:零)。 receive any remuneration for their services rendered to the Council (2024:

Nil).

22. 其他支出 22. OTHER EXPENSES

集團 生產力局

The Group The Council

2025 2024 2025 2024

港幣千元 港幣千元 港幣千元 港幣千元

HK$’000 HK$’000 HK$’000 HK$’000

一般及行政支出 General and administrative 89,212 65,304 87,401 63,331

expenses

項目相關支出 Project related expenses 453,544 421,714 442,339 402,196

出售物業、廠房和設備虧損 Loss on disposals of property, 349 977 332 946

plant and equipment

無形資產的出售虧損 Loss on disposals of intangible asset 5 - - -

折舊 Depreciation

-物業、廠房和設備 - property, plant and equipment 43,750 38,052 43,715 37,870

-使用權資產 - right-of-use assets 519 485 459 424

無形資產攤銷 Amortisation of intangible assets 14,677 8,563 14,527 8,561

租賃負債之利息 Interest expense on 106 5 105 -

lease liabilities

核數師酬金 Auditor's remuneration 935 1,067 548 531

雜項支出 Sundry expenses 16,826 14,671 16,224 14,048

619,923 550,838 605,650 527,907

23. 所得稅 23. INCOME TAX

(a) 綜合收支賬目所示的所得稅為: (a) Income tax in the consolidated income and expenditure

account represents:

集團

The Group

2025 2024

港幣千元 港幣千元

HK$’000 HK$’000

本期‒香港以外 Current tax ‒ outside Hong Kong

年度撥備 Provision for the year 131 115

由於生產力局獲稅務局根據香港《稅務條例》第87條 The Council is not subject to Hong Kong profits tax as the Council has been

豁免繳納所有香港稅項,因此毋須繳納香港利得稅。 granted exemption from all Hong Kong taxes by the Inland Revenue

Department under Section 87 of the Inland Revenue Ordinance.

由於生產力局的香港附屬公司於截至2025年3月31日 No provision for Hong Kong profits tax for the Council's Hong Kong

年度內 無應課稅盈利,故並無作出香港利得稅撥備 subsidiaries has been made as they did not have assessable profit during the

year ended 31 March 2025 (2024: Nil).

(2024年:無)。

48 獨立核數師報告及財務報告 INDEPENDENT AUDITOR’S REPORT AND FINANCIAL STATEMENTS 2024-25