Page 52 - Hong Kong Productivity Council Independent Auditor’s Report and Financial Statements 2024-25

P. 52

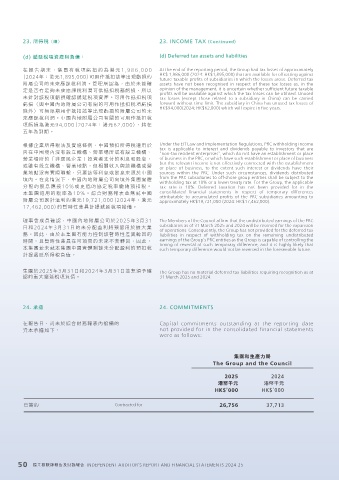

23. 所得稅(續) 23. INCOME TAX (Continued)

(d) 遞延稅項資產與負債: (d) Deferred tax assets and liabilities

在報告期末,集團有稅項虧損約為港元1,986,000 At the end of the reporting period, the Group had tax losses of approximately

(2024年:港元1,895,000)可用作抵扣該等出現虧損的 HK$ 1,986,000 (2024: HK$1,895,000) that are available for offsetting against

future taxable profits of subsidiaries in which the losses arose. Deferred tax

附屬公司的未來應課稅利潤。管理層認為,由於未能確 assets have not been recognised in respect of these tax losses as, in the

定是否有足夠未來應課稅利潤可供抵扣稅務虧損,所以 opinion of the management, it is uncertain whether sufficient future taxable

profits will be available against which the tax losses can be utilised. Unused

未針對該稅項虧損確認遞延稅項資產。可用作抵扣稅項 tax losses (except those related to a subsidiary in China) can be carried

虧損(與中國內地附屬公司有關的可用作抵扣稅項虧損 forward without time limit. The subsidiary in China has unused tax losses of

除外)可無限期用作抵扣該等出現虧損的附屬公司的未 HK$94,000(2024: HK$62,000) which will expire in five years.

來應課稅利潤。中國內地附屬公司有關的可用作抵扣稅

項虧損為港元94,000(2024年:港元62,000),將在

五年為到期。

根據企業所得稅法及實施條例,中國預扣所得稅適用於 Under the EIT Law and Implementation Regulations, PRC withholding income

tax is applicable to interest and dividends payable to investors that are

向在中國境內沒有設立機構、營業場所或有設立機構、 “non-tax resident enterprises”, which do not have an establishment or place

營業場所的「非居民企業」投資者支付的利息和股息, of business in the PRC, or which have such establishment or place of business

或雖有設立機構、營業地點,但相關收入與該機構或營 but the relevant income is not effectively connected with the establishment

or place of business, to the extent such interest or dividends have their

業地點沒有實際聯繫,只要該等利息或股息來源於中國 sources within the PRC. Under such circumstances, dividends distributed

境內。在此情況下,中國內地附屬公司向境外集團實體 from the PRC subsidiaries to off-shore group entities shall be subject to the

withholding tax at 10% or a lower treaty rate. For the Group, the applicable

分配的股息應按10%或更低的協定稅率繳納預扣稅。 tax rate is 10%. Deferred taxation has not been provided for in the

本集團適用的稅率為10%。綜合財務報表並無就中國 consolidated financial statements in respect of temporary differences

attributable to accumulated profits of the PRC subsidiaries amounting to

附屬公司累計溢利約港元19,721,000(2024年:港元 approximately HK$19,721,000 (2024: HK$17,462,000).

17,462,000)的暫時性差異計提遞延稅項撥備。

理事會成員確認,中國內地附屬公司於2025年3月31 The Members of the Council affirm that the undistributed earnings of the PRC

日和2024年3月31日的未分配盈利將預留用於擴大業 subsidiaries as of 31 March 2025 and 2024 will be reserved for the expansion

of operations. Consequently, the Group has not provided for the deferred tax

務。因此,由於本集團有能力控制該暫時性差異轉回的 liabilities in respect of withholding tax on the remaining undistributed

時間,且暫時性差異在可預見的未來不會轉回,因此, earnings of the Group’s PRC entities as the Group is capable of controlling the

timing of reversal of such temporary difference, and it is highly likely that

本集團並未就本集團中國實體剩餘未分配盈利的預扣稅 such temporary difference would not be reversed in the foreseeable future.

計提遞延所得稅負債。

集團於2025年3月31日和2024年3月31日並無須予確 The Group has no material deferred tax liabilities requiring recognition as at

認的重大遞延稅項負債。 31 March 2025 and 2024.

24. 承擔 24. COMMITMENTS

在報告日,尚未於綜合財務報表內撥備的 Capital commitments outstanding at the reporting date

資本承擔如下: not provided for in the consolidated financial statements

were as follows:

集團和生產力局

The Group and the Council

2025 2024

港幣千元 港幣千元

HK$’000 HK$’000

已簽約 Contracted for 26,756 37,713

50 獨立核數師報告及財務報告 INDEPENDENT AUDITOR’S REPORT AND FINANCIAL STATEMENTS 2024-25