Page 54 - Hong Kong Productivity Council Independent Auditor’s Report and Financial Statements 2024-25

P. 54

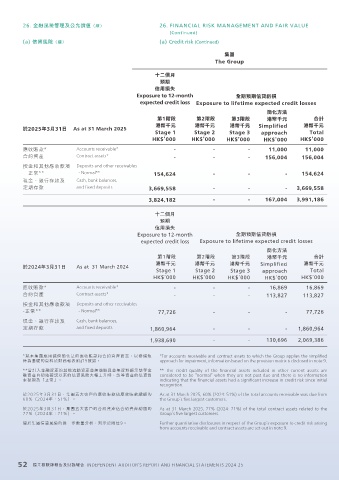

26. 金融風險管理及公允價值(續) 26. FINANCIAL RISK MANAGEMENT AND FAIR VALUE

(Continued)

(a) 信貸風險(續) (a) Credit risk (Continued)

集團

The Group

十二個月

預期

信用損失

Exposure to 12-month 全期預期信貸虧損

expected credit loss Exposure to lifetime expected credit losses

簡化方法

第1階段 第2階段 第3階段 港幣千元 合計

港幣千元 港幣千元 港幣千元 Simplified 港幣千元

於2025年3月31日 As at 31 March 2025

Stage 1 Stage 2 Stage 3 approach Total

HK$’000 HK$’000 HK$’000 HK$’000 HK$’000

應收賬款* Accounts receivable* - - - 11,000 11,000

合約資產 Contract assets* - - - 156,004 156,004

按金和其他應收款項 Deposits and other receivables

-正常** - Normal** 154,624 - - - 154,624

現金、銀行存款及 Cash, bank balances,

定期存款 and fixed deposits 3,669,558 - - - 3,669,558

3,824,182 - - 167,004 3,991,186

十二個月

預期

信用損失

Exposure to 12-month 全期預期信貸虧損

expected credit loss Exposure to lifetime expected credit losses

簡化方法

第1階段 第2階段 第3階段 港幣千元 合計

港幣千元 港幣千元 港幣千元 Simplified 港幣千元

於2024年3月31日 As at 31 March 2024

Stage 1 Stage 2 Stage 3 approach Total

HK$’000 HK$’000 HK$’000 HK$’000 HK$’000

應收賬款* Accounts receivable* - - - 16,869 16,869

合約資產 Contract assets* - - - 113,827 113,827

按金和其他應收款項 Deposits and other receivables

-正常** - Normal** 77,726 - - - 77,726

現金、銀行存款及 Cash, bank balances,

定期存款 and fixed deposits 1,860,964 - - - 1,860,964

1,938,690 - - 130,696 2,069,386

*就本集團應用減值簡化法的應收賬款和合約資產而言,以撥備矩 *For accounts receivable and contract assets to which the Group applies the simplified

陣為基礎的資料於財務報表附註9披露。 approach for impairment, information based on the provision matrix is disclosed in note 9.

**當計入金融資產的其他流動資產並無逾期且並無資料顯示該等金 ** The credit quality of the financial assets included in other current assets are

融資產自初始確認以來的信貸風險大幅上升時,該等資產的信貸質 considered to be “normal” when they are not past due and there is no information

素被視為「正常」。 indicating that the financial assets had a significant increase in credit risk since initial

recognition.

於2025年3月31日,集團五大客戶的應收賬款佔應收賬款總額的 As at 31 March 2025, 60% (2024: 51%) of the total accounts receivable was due from

60%(2024年:51%)。 the Group’s five largest customers.

於2025年3月31日,集團五大客戶的合約資產佔合約資產總額的 As at 31 March 2025, 77% (2024: 71%) of the total contract assets related to the

77%(2024年:71%)。 Group’s five largest customers.

關於集團信貸風險的進一步數量分析,列示於附註9。 Further quantitative disclosures in respect of the Group’s exposure to credit risk arising

from accounts receivable and contract assets are set out in note 9.

52 獨立核數師報告及財務報告 INDEPENDENT AUDITOR’S REPORT AND FINANCIAL STATEMENTS 2024-25