Page 53 - Hong Kong Productivity Council Independent Auditor’s Report and Financial Statements 2024-25

P. 53

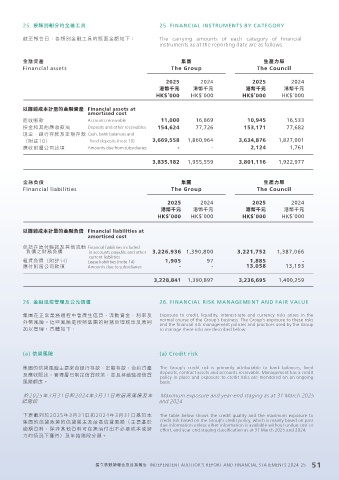

25. 按類別劃分的金融工具 25. FINANCIAL INSTRUMENTS BY CATEGORY

截至報告日,各類別金融工具的賬面金額如下: The carrying amounts of each category of financial

instruments as at the reporting date are as follows:

金融資產 集團 生產力局

Financial assets The Group The Council

2025 2024 2025 2024

港幣千元 港幣千元 港幣千元 港幣千元

HK$’000 HK$’000 HK$’000 HK$’000

以攤銷成本計量的金融資產 Financial assets at

amortised cost

應收賬款 Accounts receivable 11,000 16,869 10,945 16,533

按金和其他應收款項 Deposits and other receivables 154,624 77,726 153,171 77,682

現金、銀行存款及定期存款 Cash, bank balances and

(附註10) fixed deposits (note 10) 3,669,558 1,860,964 3,634,876 1,827,001

應收附屬公司款項 Amounts due from subsidiaries - - 2,124 1,761

3,835,182 1,955,559 3,801,116 1,922,977

金融負債 集團 生產力局

Financial liabilities The Group The Council

2025 2024 2025 2024

港幣千元 港幣千元 港幣千元 港幣千元

HK$’000 HK$’000 HK$’000 HK$’000

以攤銷成本計量的金融負債 Financial liabilities at

amortised cost

包括在應付賬款及其他流動 Financial liabilities included

負債之財務負債 in accounts payable and other 3,226,936 1,390,800 3,221,752 1,387,066

current liabilities

租賃負債(附註14) Lease liabilities (note 14) 1,905 97 1,885 -

應付附屬公司款項 Amounts due to subsidiaries - - 13,058 13,193

3,228,841 1,390,897 3,236,695 1,400,259

26. 金融風險管理及公允價值 26. FINANCIAL RISK MANAGEMENT AND FAIR VALUE

集團在正常業務過程中會產生信貸、流動資金、利率及 Exposure to credit, liquidity, interest-rate and currency risks arises in the

外幣風險。這些風險是按照集團的財務管理政策及原則 normal course of the Group's business. The Group's exposure to these risks

and the financial risk management policies and practices used by the Group

加以管理,具體如下: to manage these risks are described below:

(a) 信貸風險 (a) Credit risk

集團的信貸風險主要來自銀行存款、定期存款、合約資產 The Group's credit risk is primarily attributable to bank balances, fixed

及應收賬款。管理層已制定信貸政策,並且持續監控信貸 deposits, contract assets and accounts receivable. Management has a credit

policy in place and exposure to credit risks are monitored on an ongoing

風險額度。 basis.

於2025年3月31日和2024年3月31日的最高風險及年 Maximum exposure and year-end staging as at 31 March 2025

結階段 and 2024

下表載列於2025年3月31日和2024年3月31日基於本 The table below shows the credit quality and the maximum exposure to

集團的信貸政策的信貸質素及最高信貸風險(主要基於 credit risk based on the Group's credit policy, which is mainly based on past

due information unless other information is available without undue cost or

逾期資料,除非其他資料可在無須付出不必要成本或努 effort, and year-end staging classification as at 31 March 2025 and 2024.

力的情況下獲得)及年結階段分類。

獨立核數師報告及財務報告 INDEPENDENT AUDITOR’S REPORT AND FINANCIAL STATEMENTS 2024-25 51