-

Our Services

- AI with HKPC PICASSO

- The Cradle – Go Global Service Centre

-

New Industrialisation

- New Industrialisation

- New Productive Forces Service Platform

- Smart Production Line

- Innovation Technology and R&D

- Transformation and Upgrading

- Nurture New Industrialisation Talent

- Rules and Regulations

-

HealthTech and Traditional Chinese Medicine

- HealthTech and Traditional Chinese Medicine

- R&D service and Functional Investigation on Chinese Medicine, Health Food & Wellness product

- Compliance Consultation Service for Chinese Medicine, Pharmaceutical, Health Food and Medical Device Industries

- Manufacturing Enhancement - Automatic Intelligent System for Production and Packaging in Chinese Medicine, Pharmaceutical and Health Food Industries

- Assisting funding application for local medicine and health industrial associations

- “The Cradle” Services for Health Tech and TCM Industry

-

Smart Manufacturing

- Smart Manufacturing

-

IIOT

- IIOT

- Industrie 4.0 - Smart Enterprise

- Product Lifecycle Management Consultancy

- Intelligent Automatic Warehousing and Logistics

- Real-Time Manufacturing Tracking System

- Knowledge Based Engineering & CAD Solution

- Location Based Services and Location Analytics

- The HATCH

- Hong Kong Industrial Drone Technology Centre

- Novel Materials

-

Advanced Manufacturing Technology

- Advanced Manufacturing Technology

- 3D Scanning and Reverse Engineering Service

- Flexible Metallic Fiber Physical Porous Part Fabrication Technology

- Advanced Mould Cooling Technology and CAE Conformal Cooling Analysis

- Gas Atomisation Technology

- Dual Laser Metal Polishing Technology

- Advanced Additive Manufacturing, 3D Printing Technology, and Direct Manufacturing

- Diffusion Bonding Technology

- Electrically-Assisted Free Forming (EAFF) Technology for Customisation of Sheet Metal Parts

- Plastic Process and Machinery Technology

- Fashion and Garment Technology

- Computer Aided Technology (CAx)

- Watch Assembly Automation Technology

-

Digital Transformation

- Digital Transformation

- HKPC Digital DIY Portal

- Digital Transformation Support

- Intelligent Integrated Non-wearable and Wearable Health Monitoring System and App for Elderly Homes

- 「FitEasy」Virtual Fitting Technology - For People with Disability

- Smart Solution

- Research and Analytics

- Strategic IT Management

- Embedded Software System

- New Media and Learning Technology Development

- IT Industry Support

- DevOps Maturity Assessment and Consultancy Service

- Software Testing Automation Consultancy Service

- Blockchain Consulting Service

- Extended Reality (XR) technology and consultancy service

-

Cyber Security

- Cyber Security

- Cyber Security

- Cybers Security-by-design, Privacy and Compliance-by-default

- Design & Architecture

- Train & Develop

- Offensive Security

- Intelligent Security

- Defensive Security

- Intelligent Hardening

- Internet of Things (IoT) & Operational Technology (OT) Cyber Security Testing

- Phishing Defence Services

- Cyber Security Assessment & Audit

- Cyber Security Consultancy for i4.0 & e4.0

-

Green & Smart Living

- Green & Smart Living

- Green Technology

- Food Technology

- Smart Living

-

Corporate Sustainability

- Corporate Sustainability

- ESG and Sustainability Services

- Manufacturing Technology (Tooling, Metals & Plastics) Recognition of Prior Learning (RPL) Mechanism

- Market Research and Analytics

- Business Innovation

- Sustainability-related standards and guidance

- Organisation Innovation Capability Development

- District Innovation

- Customer Service Assessment

- Intellectual Property (IP) Protection and Management

- Support to Creative Industries

- Manufacturing Standards Consultancy Service

- Production Capacity Optimisation

- Cost of Quality

- HKPC Academy

- SME Support

- Funding

- Testing & Standards

- Venues & Facilities

-

Support & Resource

- Technology Transfer

-

Support Centres

- Support Centres

- Future Life and Health Tech Centre & Future FoodTech Lab

- Low-altitude Economy Tech Hall

- The Cradle – Go Global Service Centre

- Agentic AI and Industrial Metaverse Hall

- HKPC-HP 3D Printing Technology Centre

- Future Manufacturing Hall

- Hong Kong Technology and Innovation Support Centre

- Inno Space

- The HATCH

- Advanced Electronics Processing Technology Centre

- Green Living Laboratory

- Reliability Testing Centre

- Electromagnetic Compatibility Centre

- Plastics Technology Centre

- Smart Wearables, Watch & Clock Technology Centre

- Conformal Cooling Technology Centre

- Hong Kong Digital Testing Hub

- Hong Kong Industrial Drone Technology Centre

- Aqua Research Laboratory

- Advanced Materials and Intelligent Manufacturing Centre

- Hong Kong Joint Research Lab for Applications of Intelligent Automation Technology

- Future FoodTech Lab

- HKUST-HKPC Joint Research Lab for Industrial AI and Robotics

- Hong Kong Industrial Artificial Intelligence & Robotics Centre (FLAIR)

- Testing & Standards

- HKPC Spotlights

- About US

-

LANGUAGE

LANGUAGE

HealthTech and Traditional Chinese Medicine

- R&D service and Functional Investigation on Chinese Medicine, Health Food & Wellness product

- Compliance Consultation Service for Chinese Medicine, Pharmaceutical, Health Food and Medical Device Industries

- Manufacturing Enhancement - Automatic Intelligent System for Production and Packaging in Chinese Medicine, Pharmaceutical and Health Food Industries

- Assisting funding application for local medicine and health industrial associations

- “The Cradle” Services for Health Tech and TCM Industry

IIOT

- Industrie 4.0 - Smart Enterprise

- Product Lifecycle Management Consultancy

- Intelligent Automatic Warehousing and Logistics

- Real-Time Manufacturing Tracking System

- Knowledge Based Engineering & CAD Solution

- Location Based Services and Location Analytics

- The HATCH

- Hong Kong Industrial Drone Technology Centre

Advanced Manufacturing Technology

- 3D Scanning and Reverse Engineering Service

- Flexible Metallic Fiber Physical Porous Part Fabrication Technology

- Advanced Mould Cooling Technology and CAE Conformal Cooling Analysis

- Gas Atomisation Technology

- Dual Laser Metal Polishing Technology

- Advanced Additive Manufacturing, 3D Printing Technology, and Direct Manufacturing

- Diffusion Bonding Technology

- Electrically-Assisted Free Forming (EAFF) Technology for Customisation of Sheet Metal Parts

- Plastic Process and Machinery Technology

- Fashion and Garment Technology

- Computer Aided Technology (CAx)

- Watch Assembly Automation Technology

Digital Transformation

- HKPC Digital DIY Portal

- Digital Transformation Support

- Intelligent Integrated Non-wearable and Wearable Health Monitoring System and App for Elderly Homes

- 「FitEasy」Virtual Fitting Technology - For People with Disability

- Smart Solution

- Research and Analytics

- Strategic IT Management

- Embedded Software System

- New Media and Learning Technology Development

- IT Industry Support

- DevOps Maturity Assessment and Consultancy Service

- Software Testing Automation Consultancy Service

- Blockchain Consulting Service

- Extended Reality (XR) technology and consultancy service

Cyber Security

- Cyber Security

- Cybers Security-by-design, Privacy and Compliance-by-default

- Design & Architecture

- Train & Develop

- Offensive Security

- Intelligent Security

- Defensive Security

- Intelligent Hardening

- Internet of Things (IoT) & Operational Technology (OT) Cyber Security Testing

- Phishing Defence Services

- Cyber Security Assessment & Audit

- Cyber Security Consultancy for i4.0 & e4.0

Corporate Sustainability

- ESG and Sustainability Services

- Manufacturing Technology (Tooling, Metals & Plastics) Recognition of Prior Learning (RPL) Mechanism

- Market Research and Analytics

- Business Innovation

- Sustainability-related standards and guidance

- Organisation Innovation Capability Development

- District Innovation

- Customer Service Assessment

- Intellectual Property (IP) Protection and Management

- Support to Creative Industries

- Manufacturing Standards Consultancy Service

- Production Capacity Optimisation

- Cost of Quality

Support Centres

- Future Life and Health Tech Centre & Future FoodTech Lab

- Low-altitude Economy Tech Hall

- The Cradle – Go Global Service Centre

- Agentic AI and Industrial Metaverse Hall

- HKPC-HP 3D Printing Technology Centre

- Future Manufacturing Hall

- Hong Kong Technology and Innovation Support Centre

- Inno Space

- The HATCH

- Advanced Electronics Processing Technology Centre

- Green Living Laboratory

- Reliability Testing Centre

- Electromagnetic Compatibility Centre

- Plastics Technology Centre

- Smart Wearables, Watch & Clock Technology Centre

- Conformal Cooling Technology Centre

- Hong Kong Digital Testing Hub

- Hong Kong Industrial Drone Technology Centre

- Aqua Research Laboratory

- Advanced Materials and Intelligent Manufacturing Centre

- Hong Kong Joint Research Lab for Applications of Intelligent Automation Technology

- Future FoodTech Lab

- HKUST-HKPC Joint Research Lab for Industrial AI and Robotics

- Hong Kong Industrial Artificial Intelligence & Robotics Centre (FLAIR)

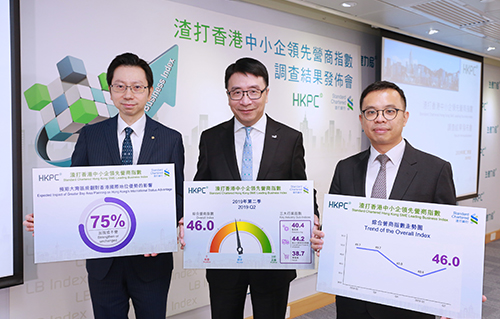

HKPC Announces 2019 Q2 Standard Chartered Hong Kong SME Leading Business Index - SMEs Anticipate Greater Bay Area Planning to Benefit Hong Kong on Global Stage

(Hong Kong, 24 April 2019) The Hong Kong Productivity Council (HKPC) today announced the second quarter result of the “Standard Chartered Hong Kong SME Leading Business Index” (Standard Chartered SME Index). Compared with the first quarter, the Overall Index of the second quarter increased by 5.6, reading at 46.0, which was the sharpest increase over the past three years. The result indicated that SMEs are rebuilding their confidence in doing business gradually.

In the second quarter of 2019, all the five sub-indices* of the Overall Index in the Standard Chartered SME Index increased simultaneously. Among all, “Staff Number” (53.0) remained at a positive level; “Investments” (49.7), “Sales Amount” (45.6) and “Profit Margin” (42.3) increased by 3.5, 7.6 and 7.6 respectively. “Global Economic Growth” recorded a relatively large increase of 10.4, bouncing back to 26.5.

In terms of industry, the three key sub-indices increased simultaneously. The “Import/Export Trade and Wholesale Industry” sub-index increased by 6.9 to 44.2. All the five sub-indices of the above industries also increased, in which “Staff Number” returned to a positive level. The “Manufacturing Industry” (40.4) and “Retail Industry” (38.7) sub-indices both increased by 6.0 and 2.6. Despite this, the “Retail Industry” sub-index was still lower than 40.0, which revealed the Industry’s negative outlook on business environment.

Mr Kelvin Lau, Senior Economist of Standard Chartered Hong Kong said, “What we are seeing is a very broad-based rebound in SME confidence after a battered Q1 -- probably a normalisation after being materially weighed down by prior deterioration in US-China trade dispute. We believe the latest readings are more in line with the fundamental picture, where a combination of better trade negotiation news headlines, a more dovish Fed in the US and generous policy stimulus in China should help create a floor to broad sentiment; but those alone are probably not enough to boost headline index back about 50 for now, or at least not until we see more concrete signs of the global business cycle bottoming out. And while the underperformance of the ‘Retail Industry’ sub-index this time was a disappointment, we believe some form of a catch-up is in store thanks to a still-tight labour market and rising local asset prices, both supporting household spending. All this adds conviction to our view that Hong Kong’s growth trajectory remains on track (albeit a modest and gradual one) to reaccelerate over the course of 2019 after a soft start to the year.”

In response to the launch of the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area (GBA), 75% respondents expected the advantage of Hong Kong’s international status would be strengthened or remain unchanged. Among the surveyed SMEs, industries including Information and Communications Industry (52%), Finance and Insurance Industry (42%) and Real Estate Industry (42%) anticipated to have a higher chance to benefit from the GBA development plan. Besides, 28% surveyed SMEs would refer to the GBA development plan to formulate the company’s development plan, while 26% would speed up digital transformation accordingly.

Dr Lawrence Cheung, Chief Innovation Officer of HKPC, said, “Local SMEs confidence are seen bouncing gradually, despite the uncertainties in global economic headwinds. SMEs are encouraged to speed up their digitalisation progress and expand their business in the fast-growing ASEAN markets and grasp opportunity of the GBA Planning. HKPC is dedicated to support enterprises to explore the GBA by organising seminars regularly for the industry to exchange latest market technology and information. Despite this, HKPC has been promoting the government’s enhanced ‘Dedicated Fund on Branding, Upgrading and Domestics Sales’ (the BUD Fund), to further assist Hong Kong enterprises in exploring the ASEAN and the Chinese Mainland markets as well as regions that will sign Free Trade Agreement with Hong Kong later on.”

The Survey of Standard Chartered SME Index for Q2 2019 was conducted in March 2019. The survey interviewed 813 local SMEs successfully. The report can be downloaded from the SME One Website (www.smeone.org).

*The five Sub-Indices are "Staff Number", "Investments", "Sales Amount", "Profit Margin" and "Global Economy Growth".

- Ends -

Dr Lawrence Cheung, Chief Innovation Director of HKPC (centre); Mr Clement Li, General Manager of Management Consulting of HKPC (left), and Mr Kelvin Lau, Senior Economist, Greater China, Standard Chartered Bank (Hong Kong) Limited (right), announced the Overall Index increased by 5.6 to 46.0 at a press conference of the “Standard Chartered Hong Kong SME Leading Business Index 2019 Q2”, which was the sharpest increase over the past three years.

Dr Lawrence Cheung, Chief Innovation Director of HKPC (centre); Mr Clement Li, General Manager of Management Consulting of HKPC (left), and Mr Kelvin Lau, Senior Economist, Greater China, Standard Chartered Bank (Hong Kong) Limited (right), announced the Overall Index increased by 5.6 to 46.0 at a press conference of the “Standard Chartered Hong Kong SME Leading Business Index 2019 Q2”, which was the sharpest increase over the past three years.

Share the latest information of HKPC to your inbox

Our Services

Support & Resource

HKPC Spotlights

COPYRIGHT© Hong Kong Productivity Council