-

Our Services

- AI with HKPC PICASSO

- The Cradle – Go Global Service Centre

-

New Industrialisation

- New Industrialisation

- New Productive Forces Service Platform

- Smart Production Line

- Innovation Technology and R&D

- Transformation and Upgrading

- Nurture New Industrialisation Talent

- Rules and Regulations

-

HealthTech and Traditional Chinese Medicine

- HealthTech and Traditional Chinese Medicine

- R&D service and Functional Investigation on Chinese Medicine, Health Food & Wellness product

- Compliance Consultation Service for Chinese Medicine, Pharmaceutical, Health Food and Medical Device Industries

- Manufacturing Enhancement - Automatic Intelligent System for Production and Packaging in Chinese Medicine, Pharmaceutical and Health Food Industries

- Assisting funding application for local medicine and health industrial associations

- “The Cradle” Services for Health Tech and TCM Industry

-

Smart Manufacturing

- Smart Manufacturing

-

IIOT

- IIOT

- Industrie 4.0 - Smart Enterprise

- Product Lifecycle Management Consultancy

- Intelligent Automatic Warehousing and Logistics

- Real-Time Manufacturing Tracking System

- Knowledge Based Engineering & CAD Solution

- Location Based Services and Location Analytics

- The HATCH

- Hong Kong Industrial Drone Technology Centre

- Novel Materials

-

Advanced Manufacturing Technology

- Advanced Manufacturing Technology

- 3D Scanning and Reverse Engineering Service

- Flexible Metallic Fiber Physical Porous Part Fabrication Technology

- Advanced Mould Cooling Technology and CAE Conformal Cooling Analysis

- Gas Atomisation Technology

- Dual Laser Metal Polishing Technology

- Advanced Additive Manufacturing, 3D Printing Technology, and Direct Manufacturing

- Diffusion Bonding Technology

- Electrically-Assisted Free Forming (EAFF) Technology for Customisation of Sheet Metal Parts

- Plastic Process and Machinery Technology

- Fashion and Garment Technology

- Computer Aided Technology (CAx)

- Watch Assembly Automation Technology

-

Digital Transformation

- Digital Transformation

- HKPC Digital DIY Portal

- Digital Transformation Support

- Intelligent Integrated Non-wearable and Wearable Health Monitoring System and App for Elderly Homes

- 「FitEasy」Virtual Fitting Technology - For People with Disability

- Smart Solution

- Research and Analytics

- Strategic IT Management

- Embedded Software System

- New Media and Learning Technology Development

- IT Industry Support

- DevOps Maturity Assessment and Consultancy Service

- Software Testing Automation Consultancy Service

- Blockchain Consulting Service

- Extended Reality (XR) technology and consultancy service

-

Cyber Security

- Cyber Security

- Cyber Security

- Cybers Security-by-design, Privacy and Compliance-by-default

- Design & Architecture

- Train & Develop

- Offensive Security

- Intelligent Security

- Defensive Security

- Intelligent Hardening

- Internet of Things (IoT) & Operational Technology (OT) Cyber Security Testing

- Phishing Defence Services

- Cyber Security Assessment & Audit

- Cyber Security Consultancy for i4.0 & e4.0

-

Green & Smart Living

- Green & Smart Living

- Green Technology

- Food Technology

- Smart Living

-

Corporate Sustainability

- Corporate Sustainability

- ESG and Sustainability Services

- Manufacturing Technology (Tooling, Metals & Plastics) Recognition of Prior Learning (RPL) Mechanism

- Market Research and Analytics

- Business Innovation

- Sustainability-related standards and guidance

- Organisation Innovation Capability Development

- District Innovation

- Customer Service Assessment

- Intellectual Property (IP) Protection and Management

- Support to Creative Industries

- Manufacturing Standards Consultancy Service

- Production Capacity Optimisation

- Cost of Quality

- HKPC Academy

- SME Support

- Funding

- Testing & Standards

- Venues & Facilities

-

Support & Resource

- Technology Transfer

-

Support Centres

- Support Centres

- Future Life and Health Tech Centre & Future FoodTech Lab

- Low-altitude Economy Tech Hall

- The Cradle – Go Global Service Centre

- Agentic AI and Industrial Metaverse Hall

- HKPC-HP 3D Printing Technology Centre

- Future Manufacturing Hall

- Hong Kong Technology and Innovation Support Centre

- Inno Space

- The HATCH

- Advanced Electronics Processing Technology Centre

- Green Living Laboratory

- Reliability Testing Centre

- Electromagnetic Compatibility Centre

- Plastics Technology Centre

- Smart Wearables, Watch & Clock Technology Centre

- Conformal Cooling Technology Centre

- Hong Kong Digital Testing Hub

- Hong Kong Industrial Drone Technology Centre

- Aqua Research Laboratory

- Advanced Materials and Intelligent Manufacturing Centre

- Hong Kong Joint Research Lab for Applications of Intelligent Automation Technology

- Future FoodTech Lab

- HKUST-HKPC Joint Research Lab for Industrial AI and Robotics

- Hong Kong Industrial Artificial Intelligence & Robotics Centre (FLAIR)

- Testing & Standards

- HKPC Spotlights

- About US

-

LANGUAGE

LANGUAGE

HealthTech and Traditional Chinese Medicine

- R&D service and Functional Investigation on Chinese Medicine, Health Food & Wellness product

- Compliance Consultation Service for Chinese Medicine, Pharmaceutical, Health Food and Medical Device Industries

- Manufacturing Enhancement - Automatic Intelligent System for Production and Packaging in Chinese Medicine, Pharmaceutical and Health Food Industries

- Assisting funding application for local medicine and health industrial associations

- “The Cradle” Services for Health Tech and TCM Industry

IIOT

- Industrie 4.0 - Smart Enterprise

- Product Lifecycle Management Consultancy

- Intelligent Automatic Warehousing and Logistics

- Real-Time Manufacturing Tracking System

- Knowledge Based Engineering & CAD Solution

- Location Based Services and Location Analytics

- The HATCH

- Hong Kong Industrial Drone Technology Centre

Advanced Manufacturing Technology

- 3D Scanning and Reverse Engineering Service

- Flexible Metallic Fiber Physical Porous Part Fabrication Technology

- Advanced Mould Cooling Technology and CAE Conformal Cooling Analysis

- Gas Atomisation Technology

- Dual Laser Metal Polishing Technology

- Advanced Additive Manufacturing, 3D Printing Technology, and Direct Manufacturing

- Diffusion Bonding Technology

- Electrically-Assisted Free Forming (EAFF) Technology for Customisation of Sheet Metal Parts

- Plastic Process and Machinery Technology

- Fashion and Garment Technology

- Computer Aided Technology (CAx)

- Watch Assembly Automation Technology

Digital Transformation

- HKPC Digital DIY Portal

- Digital Transformation Support

- Intelligent Integrated Non-wearable and Wearable Health Monitoring System and App for Elderly Homes

- 「FitEasy」Virtual Fitting Technology - For People with Disability

- Smart Solution

- Research and Analytics

- Strategic IT Management

- Embedded Software System

- New Media and Learning Technology Development

- IT Industry Support

- DevOps Maturity Assessment and Consultancy Service

- Software Testing Automation Consultancy Service

- Blockchain Consulting Service

- Extended Reality (XR) technology and consultancy service

Cyber Security

- Cyber Security

- Cybers Security-by-design, Privacy and Compliance-by-default

- Design & Architecture

- Train & Develop

- Offensive Security

- Intelligent Security

- Defensive Security

- Intelligent Hardening

- Internet of Things (IoT) & Operational Technology (OT) Cyber Security Testing

- Phishing Defence Services

- Cyber Security Assessment & Audit

- Cyber Security Consultancy for i4.0 & e4.0

Corporate Sustainability

- ESG and Sustainability Services

- Manufacturing Technology (Tooling, Metals & Plastics) Recognition of Prior Learning (RPL) Mechanism

- Market Research and Analytics

- Business Innovation

- Sustainability-related standards and guidance

- Organisation Innovation Capability Development

- District Innovation

- Customer Service Assessment

- Intellectual Property (IP) Protection and Management

- Support to Creative Industries

- Manufacturing Standards Consultancy Service

- Production Capacity Optimisation

- Cost of Quality

Support Centres

- Future Life and Health Tech Centre & Future FoodTech Lab

- Low-altitude Economy Tech Hall

- The Cradle – Go Global Service Centre

- Agentic AI and Industrial Metaverse Hall

- HKPC-HP 3D Printing Technology Centre

- Future Manufacturing Hall

- Hong Kong Technology and Innovation Support Centre

- Inno Space

- The HATCH

- Advanced Electronics Processing Technology Centre

- Green Living Laboratory

- Reliability Testing Centre

- Electromagnetic Compatibility Centre

- Plastics Technology Centre

- Smart Wearables, Watch & Clock Technology Centre

- Conformal Cooling Technology Centre

- Hong Kong Digital Testing Hub

- Hong Kong Industrial Drone Technology Centre

- Aqua Research Laboratory

- Advanced Materials and Intelligent Manufacturing Centre

- Hong Kong Joint Research Lab for Applications of Intelligent Automation Technology

- Future FoodTech Lab

- HKUST-HKPC Joint Research Lab for Industrial AI and Robotics

- Hong Kong Industrial Artificial Intelligence & Robotics Centre (FLAIR)

Hong Kong Monetary Authority - Hong Kong Productivity Council: Survey on Small and Medium-Sized Enterprises (SMEs)' Credit Conditions

Introduction

In light of the importance of SMEs to the Hong Kong economy and concerns about potential funding difficulties facing SMEs over the past few years, the Hong Kong Monetary Authority (HKMA) has appointed the Hong Kong Productivity Council (HKPC) to carry out this survey, starting from the third quarter of 2016. The results of this survey can help monitor the development of SMEs' access to bank credit from the demand-side perspective.

The survey collected data from around 2,500 SMEs, based on publicly available SME directories and a database from HKSAR Census and Statistics Department. The sample is stratified by the Hong Kong Standard Industrial Classification (HSIC) version 2.0, and based on the number of SME establishments in Hong Kong.

Latest Statistics

(Updated 2 February 2026)

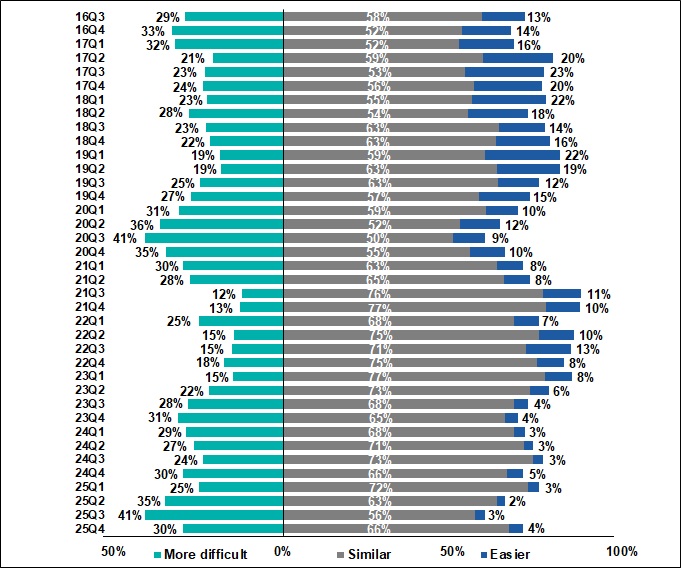

| Comparison of perceived banks' credit approval stance relative to 6 months ago(1)(2) | ||

| 2025 Q3 | ||

| More difficult | Similar | Easier |

| 41% | 56% | 3% |

| 2025 Q4 | ||

| More difficult | Similar | Easier |

| 30% | 66% | 4% |

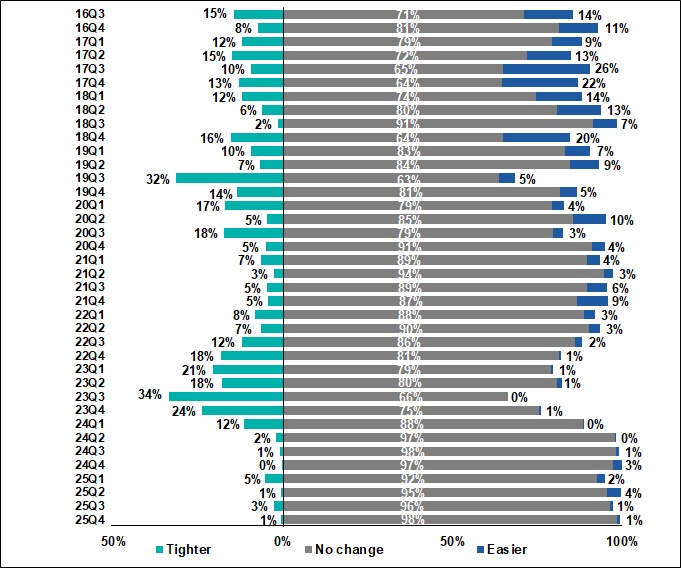

| Change in banks' stance on existing credit lines(1)(3) | ||

| 2025 Q3 | ||

| Tighter | No change | Easier |

| 3% | 96% | 1% |

| 2025 Q4 | ||

| Tighter | No change | Easier |

| 1% | 98% | 1% |

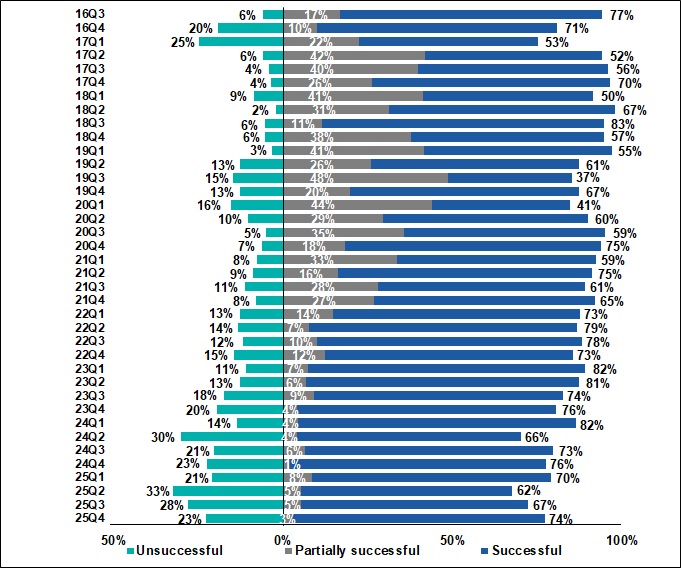

| Results of new bank credit applications(1)(4) | ||

| 2025 Q3 | ||

| Unsuccessful | Partially successful | Successful |

| 28% | 5% | 67% |

| 2025 Q4 | ||

| Unsuccessful | Partially successful | Successful |

| 23% | 3% | 74% |

(1) Figures may not add up to 100% due to rounding.

(2) Excluding respondents who answered “no idea / don’t know”.

(3) Covering only respondents with existing credit lines.

(4) Covering only respondents who had already known their new bank credit application outcomes.

Press Release

The survey is conducted quarterly starting from 2016Q3, with the results being announced after the completion of 2017 surveys.

| Quarter | Release date | Link |

|---|---|---|

| Fourth Quarter 2025 Survey | 2 February 2026 | View |

| Third Quarter 2025 Survey | 7 November 2025 | View |

| Second Quarter 2025 Survey | 1 August 2025 | View |

| First Quarter 2025 Survey | 6 May 2025 | View |

| Fourth Quarter 2024 Survey | 3 February 2025 | View |

| Third Quarter 2024 Survey | 4 November 2024 | View |

| Second Quarter 2024 Survey | 1 August 2024 | View |

| First Quarter 2024 Survey | 6 May 2024 | View |

| Fourth Quarter 2023 Survey | 5 February 2024 | View |

| Third Quarter 2023 Survey | 17 November 2023 | View |

| Second Quarter 2023 Survey | 1 August 2023 | View |

| First Quarter 2023 Survey | 8 May 2023 | View |

| Fourth Quarter 2022 Survey | 6 February 2023 | View |

| Third Quarter 2022 Survey | 30 November 2022 | View |

| Second Quarter 2022 Survey | 1 August 2022 | View |

| First Quarter 2022 Survey | 3 May 2022 | View |

| Fourth Quarter 2021 Survey | 7 February 2022 | View |

| Third Quarter 2021 Survey | 2 November 2021 | View |

| Second Quarter 2021 Survey | 29 July 2021 | View |

| First Quarter 2021 Survey | 3 May 2021 | View |

| Fourth Quarter 2020 Survey | 1 February 2021 | View |

| Third Quarter 2020 Survey | 2 November 2020 | View |

| Second Quarter 2020 Survey | 29 July 2020 | View |

| First Quarter 2020 Survey | 4 May 2020 | View |

| Fourth Quarter 2019 Survey | 2 March 2020 | View |

| Third Quarter 2019 Survey | 4 November 2019 | View |

| Second Quarter 2019 Survey | 25 July 2019 | View |

| First Quarter 2019 Survey | 6 May 2019 | View |

| Fourth Quarter 2018 Survey | 19 February 2019 | View |

| Third Quarter 2018 Survey | 7 November 2018 | View |

| Second Quarter 2018 Survey | 26 July 2018 | View |

| First Quarter 2018 Survey | 16 May 2018 | View |

| Fourth Quarter 2017 Survey | 7 February 2018 | View |

Tables & Charts

1. Comparison of perceived banks' credit approval stance relative to 6 months ago 2016Q3-2025Q4

2. Change in banks' stance on existing credit lines 2016Q3-2025Q4

3. Results of new bank credit applications 2016Q3-2025Q4

Concepts and methodology

The survey gathers views on access to bank credit from the senior management of around 2,500 SMEs from different sectors in Hong Kong, including manufacturing, import/export trade and wholesale, retail trade, accommodation and food services, transportation, storage, postal and courier services, information and communications, finance and insurance, real estate, professional services and scientific activities, social & personal services and others sectors.

The samples were stratified by sector. Quota control was imposed such that the number of samples in each stratum is proportional to the number of establishments in the population. Adjustments were made to ensure that there were no less than 80 samples in each stratum.

To classify SMEs, the definition stated in Support and Consultation Centre for SMEs, HKSAR Trade and Industry Department was adopted. Manufacturing establishments with fewer than 100 employees; and non-manufacturing establishments with fewer than 50 employees, are regarded as SMEs in Hong Kong.

Banks, deposit taking companies and other money lending companies were outside the scope of this survey.

The survey solicits views from respondents regarding SMEs' perception on banks' credit approval stance relative to 6 months ago, views of SMEs on banks' stance on existing credit lines and results of new bank credit applications. Views collected refer only to respondents’ views on their own establishments rather than views on respective sectors they are engaged in; and are limited to the expected direction of inter-quarter changes (e.g. “tighter”, “no change” or “easier”) without providing information about the magnitude of these changes.

It has to be noted that the views collected in the survey are affected by changes in sentiment due to idiosyncratic events that occurred over the survey period, which can make the results prone to fluctuations. Readers are advised to interpret the results together with other economic and financial information.

Furthermore, owing to small sample sizes of SMEs with existing credit lines and with new credit applications during the quarter, the results could be prone to large fluctuations, and hence should be interpreted with care.

Disclaimer

The content and data in this report is owned by Hong Kong Monetary Authority (HKMA). Without the authorization of HKMA, any changes to the report content and data, as well as selling of the report, are not permitted. HKMA and Hong Kong Productivity Council (HKPC) shall not have any liability, duty or obligation for or relating to the content and data contained herein, any errors, inaccuracies, omissions or delays in the content and data, or for any actions taken in reliance thereon. In no event shall HKMA or HKPC be liable for any special, incidental or consequential damages, arising out of the use of the content and data.

Enquiry

For more details about the Survey, please contact HKPC at tel. (852) 2788 5306.

Share the latest information of HKPC to your inbox

Our Services

Support & Resource

HKPC Spotlights

COPYRIGHT© Hong Kong Productivity Council