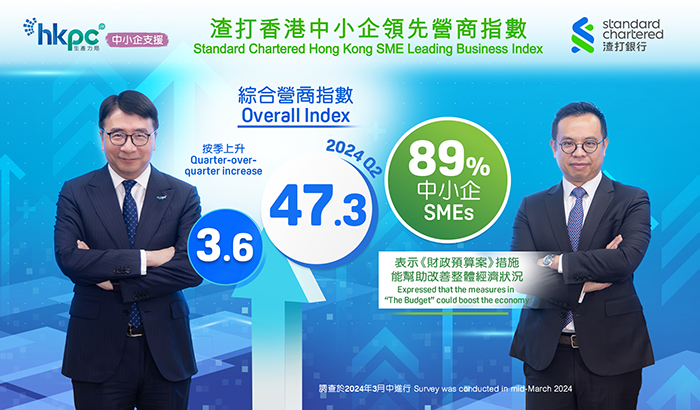

“HKPC SME Support” Announces “Standard Chartered Hong Kong SME Leading Business Index” Q2 2024 Overall Index Rebounded by 3.6 to 47.3 Rising Outflow of Local Consumer Spending May Increase Pressure on SMEs The Government Promotes Mega Events to Boost the Economy

(Hong Kong, 30 April 2024) “HKPC SME Support” today announced the “Standard Chartered Hong Kong SME Leading Business Index” (“Standard Chartered SME Index”) for the second quarter (Q2) of 2024. The Overall Index rebounded by 3.6 to 47.3, up to the level in the fourth quarter (Q4) of 2023 (47.6). Of the five component sub-indices1, except for “Recruitment Sentiment” which recorded a slight decline (51.3, -0.7), the remaining four rebounded to the level in Q4 2023, including "Global Economy" (39.4, +9.1), "Business Condition" (47.4, +7.2), "Profit Margin" (43.4, +6.3) and "Investment Sentiment" (49.5, +0.7), reflecting that local Small and Medium Enterprises (SMEs) have become more optimistic on their business turnover this quarter. "Global Economy" stopped declining after three consecutive quarters of decline and rebounded this quarter, up to the level in the third quarter (Q3) of 2023 (40.3).

“Standard Chartered SME Index” Survey Results

In terms of the 11 industry indices, "Information and Communications" (57.7) recorded the largest increment of 13.8, while "Real Estate" recorded an increment of more than 10 points (+11.2) to 52.3 this quarter. Both industries returned to the level above the 50 neutral line. On the contrary, three of the industries recorded declines. The largest drop was recorded for "Accommodation and Food Services" (42.6, -4.5), while "Financing and Insurance" (51.7, -1.3) and "Social and Personal Services" (50.7, -1.3) recorded slight declines.

In terms of overall investment trends, 92% of the surveyed SMEs indicated that they would maintain or increase investment this quarter, which is on par with the previous quarter. The areas that most SMEs expected to maintain or increase investment were "Research and Development", "IT System", "Online/ Offline Marketing Promotion", "Training Related to E-commerce or Digital Technology", "Overall Staff Training" and "Facilities and Equipment". Among them, "Research and Development" and "Facilities and Equipment" showed significant growth in this quarter, reflecting that the SMEs are more willing to use technology to upgrade and transform, such as through smart production, to improve both production efficiency and product quality.

In terms of the changes in cost components, the proportion of local SMEs expecting raw materials cost to increase continued to rise, up by 4 percentage points to 63%. On the contrary, the proportion of SMEs expecting an increase in staff salary retreated by 5 percentage points to 30%. On the other hand, only 23% of SMEs planned to increase the price of their product or service, which is on par with the previous quarter, indicating that most SMEs continue to face cost pressure, but are unable to shift the pressure to the consumers.

Dr Lawrence CHEUNG, Chief Innovation Officer of HKPC, said, “Looking ahead to the second quarter, the overall business sentiment of SMEs is gradually improving, and the Overall Index rebounded by 3.6 to 47.3. With the further recovery of the local tourism industry, the latest figures show that the number of visitor arrivals to Hong Kong in the first quarter of this year exceeded 11 million, with a growth rate of 2.7 times in new market sources. The Mainland is approaching the Golden Week holiday, which is expected to provide certain support to the local retail, catering, and transportation sectors. The industry index of 'Retail' was up by 4.4 to 43.2 this quarter, returning to a similar level as Q4 2023. However, the industry is simultaneously facing the transformation of the travel pattens of the Mainland visitors to Hong Kong and the surge in consumption by Hong Kong residents in the Mainland, resulting in insufficient consumption momentum in Hong Kong. The catering and retail sectors have not witnessed the anticipated recovery, and the industry index of 'Accommodation and Food Services' has declined for two consecutive quarters, with a cumulative decline of 12.9 points. The recent consumption patterns of the Mainland visitors to Hong Kong have shifted from shopping to experiential and immersive activities, deviating from traditional shopping behaviors. Facing rapid changes in consumption patterns and market dynamics, some local SMEs are facing dual pressures. Attracting more high-value overnight visitors by expanding customer sources has always been a major strategy for Hong Kong's tourism development. Additionally, the ‘Individual Visit’ is currently implemented in 51 cities of China, offering potential for these travelers to become high-value overnight visitors to Hong Kong. Therefore, there is still confidence in the development of Hong Kong's catering, tourism, retail, and hotel industries.”

Mr Kelvin LAU, Senior Economist, Greater China, Global Research, Standard Chartered Bank (Hong Kong) Limited, said, “A higher Q2 headline index reflects lessened pessimism among local SMEs since the beginning of the year. The improvement has been driven by better sales and profits prospects, indicating an uptick in real economic activity of late. A strong rebound in the ‘Global Economy’ sub-index also matches the China economy’s solid start to the year so far. Industry-wise, we are encouraged by the sizeable jumps in the ‘Information and Communications’ and ‘Real Estate’ industry indices, as policy support becomes more of a tailwind for both sectors. That said, with most other industry indices remaining below the 50 neutral level, it remains too early to call for a sustained return in optimism for the overall Hong Kong economy. In particular, we remain cautious towards the spending outlook by local residents and inbound tourists, with the ‘Retail’ industry index being the lowest among our three largest industry groups (the other two being ‘Manufacturing’ and ‘Import / Export Trade and Wholesale’), and ‘Accommodation and Food Services’ industry index registering the biggest quarter-on-quarter drop among all industries. With the risk of these domestic drivers fading further after a strong initial post-COVID rebound, pressure will be on the external sectors to start taking up some of the slack soon.”

Thematic Survey Results

The thematic survey of this quarter explored the views of local SMEs in response to the measures in “The 2024-25 Budget” (“The Budget”). The survey found 89% of SMEs expressed that at least one of the measures in “The Budget” could boost the overall economy. The top five measures that most SMEs believed can boost the overall economy were: "Offering loans / funding support to SMEs", "Reduction of rates, salaries tax and profits tax", "‘Revocation of harsh measures’ in the property market", "Organising international conferences and exhibitions" and "Strengthen tourism development and organise events". Looking at specific industries, the "‘Revocation of harsh measures’ in the property market" was the most beneficial for the “Real Estate” industry, while "Strengthening tourism development and organising events" was seen as the most helpful for the “Accommodation and Food Services” industry.

The survey also found areas that SMEs needed support from the HKSAR Government included “Technology Support / Digital Transformation” (27%), “Financing” (25%), “Local business expansion” (24%), “Talent recruitment and training” (22%), “Marketing” (21%) and “Mainland / Overseas business expansion” (21%).

Dr CHEUNG continued, “The Government has proposed multiple measures in ‘The Budget’, aiming to alleviate the pressure on SMEs from various perspectives and create greater business opportunities for them, assisting in market expansion and digital transformation. The thematic survey indicated that SMEs generally recognise two measures in ‘The Budget’, namely 'Organising international conferences and exhibitions' and 'Strengthen tourism development and organise events', as two of the most effective measures to boost the economy. With the Government launching a series of post-pandemic events, such as the ‘Art March’ featuring 12 major activities, including the ‘Art Basel Hong Kong’, which welcomed 75,000 visitors this year, and a series of top-tier international conferences, these events have brought popularity and prosperity, demonstrating the potential for conference economy and investment opportunities in Hong Kong. In addition to revitalising the local tourism, retail, and catering industries, Hong Kong also needs to continue reshaping its international image as an events capital to cater the needs of travellers, attract high-value visitors, and encourage residents to consume locally, thus bolstering internal consumption growth.”

In terms of Financing, 42% of the SMEs with financing needs in the past 12 months reported difficulties in borrowing or obtaining new funds, while nearly 50% reported fair and the remaining 12% reported easy. Nearly 80% of SMEs indicated that they were aware of at least one funding scheme provided by the Government, with the “SME Financing Guarantee Scheme”, “Technology Voucher Programme (TVP)”, “SME Export Marketing Fund (EMF)” and “BUD Fund” showed higher levels of awareness.

The Government has granted a two-year extension to the application period for guaranteed products at 80% and 90% under the “SME Financing Guarantee Scheme” until the end of March 2026, as well increased the total credit guarantee commitment under the scheme by HK$10 billion. to support our continued assistance to SMEs in applying for Government funding and enhancing related services over the next five years. While HKPC is the professional administrator for 10 Government funding schemes, HKPC welcomes the Budget’s proposals to allocate HKD 100 million to support us in continuing to assist SMEs in applying for Government funding and enhancing related services in the next five years. Dr CHEUNG added, “With the increasingly fierce market competition driven by global economic integration, the competition in the Hong Kong market is intensifying. SMEs face significant competition in market share, brand recognition, and customer base. As an all-in-one platform that provides information and advisory services, SMEs can make good use of our strong network and professional technical knowledge to create cross-sector synergies and provide the most appropriate and comprehensive solutions to address pain points at different stages of business development.”

Conducted in March 2024, the Standard Chartered SME Index Q2 2024 survey successfully interviewed 811 local SMEs. The report will be available for download from HKPC website: https://www.hkpc.org/en/about-us/hkpc-publication/industry-insight/scbi.

To learn more about HKPC’s smart solutions to help enhance the productivity of SMEs with advanced technology, please visit the dedicated webpage: https://smarter.hkpc.org.

1The five sub-indices include “Recruitment Sentiment”, “Investment Sentiment”, “Business Condition”, “Profit Margin” and “Global Economy”.

- Ends -

At the Press Conference of the “Standard Chartered SME Index” Q2 2024, Dr Lawrence CHEUNG, Chief Innovation Officer of HKPC (left) and Mr Kelvin LAU, Senior Economist, Greater China, Global Research, Standard Chartered Hong Kong (right) announced that the Overall Index rebounded by 3.6 to 47.3 this quarter.

At the Press Conference of the “Standard Chartered SME Index” Q2 2024, Dr Lawrence CHEUNG, Chief Innovation Officer of HKPC (left) and Mr Kelvin LAU, Senior Economist, Greater China, Global Research, Standard Chartered Hong Kong (right) announced that the Overall Index rebounded by 3.6 to 47.3 this quarter.

Share the latest information of HKPC to your inbox

LANGUAGE

LANGUAGE