-

Our Services

- AI with HKPC PICASSO

- The Cradle – Go Global Service Centre

-

New Industrialisation

- New Industrialisation

- New Productive Forces Service Platform

- Smart Production Line

- Innovation Technology and R&D

- Transformation and Upgrading

- Nurture New Industrialisation Talent

- Rules and Regulations

-

HealthTech and Traditional Chinese Medicine

- HealthTech and Traditional Chinese Medicine

- R&D service and Functional Investigation on Chinese Medicine, Health Food & Wellness product

- Compliance Consultation Service for Chinese Medicine, Pharmaceutical, Health Food and Medical Device Industries

- Manufacturing Enhancement - Automatic Intelligent System for Production and Packaging in Chinese Medicine, Pharmaceutical and Health Food Industries

- Assisting funding application for local medicine and health industrial associations

- “The Cradle” Services for Health Tech and TCM Industry

-

Smart Manufacturing

- Smart Manufacturing

-

IIOT

- IIOT

- Industrie 4.0 - Smart Enterprise

- Product Lifecycle Management Consultancy

- Intelligent Automatic Warehousing and Logistics

- Real-Time Manufacturing Tracking System

- Knowledge Based Engineering & CAD Solution

- Location Based Services and Location Analytics

- The HATCH

- Hong Kong Industrial Drone Technology Centre

- Novel Materials

-

Advanced Manufacturing Technology

- Advanced Manufacturing Technology

- 3D Scanning and Reverse Engineering Service

- Flexible Metallic Fiber Physical Porous Part Fabrication Technology

- Advanced Mould Cooling Technology and CAE Conformal Cooling Analysis

- Gas Atomisation Technology

- Dual Laser Metal Polishing Technology

- Advanced Additive Manufacturing, 3D Printing Technology, and Direct Manufacturing

- Diffusion Bonding Technology

- Electrically-Assisted Free Forming (EAFF) Technology for Customisation of Sheet Metal Parts

- Plastic Process and Machinery Technology

- Fashion and Garment Technology

- Computer Aided Technology (CAx)

- Watch Assembly Automation Technology

-

Digital Transformation

- Digital Transformation

- HKPC Digital DIY Portal

- Digital Transformation Support

- Intelligent Integrated Non-wearable and Wearable Health Monitoring System and App for Elderly Homes

- 「FitEasy」Virtual Fitting Technology - For People with Disability

- Smart Solution

- Research and Analytics

- Strategic IT Management

- Embedded Software System

- New Media and Learning Technology Development

- IT Industry Support

- DevOps Maturity Assessment and Consultancy Service

- Software Testing Automation Consultancy Service

- Blockchain Consulting Service

- Extended Reality (XR) technology and consultancy service

-

Cyber Security

- Cyber Security

- Cyber Security

- Cybers Security-by-design, Privacy and Compliance-by-default

- Design & Architecture

- Train & Develop

- Offensive Security

- Intelligent Security

- Defensive Security

- Intelligent Hardening

- Internet of Things (IoT) & Operational Technology (OT) Cyber Security Testing

- Phishing Defence Services

- Cyber Security Assessment & Audit

- Cyber Security Consultancy for i4.0 & e4.0

-

Green & Smart Living

- Green & Smart Living

- Green Technology

- Food Technology

- Smart Living

-

Corporate Sustainability

- Corporate Sustainability

- ESG and Sustainability Services

- Manufacturing Technology (Tooling, Metals & Plastics) Recognition of Prior Learning (RPL) Mechanism

- Market Research and Analytics

- Business Innovation

- Sustainability-related standards and guidance

- Organisation Innovation Capability Development

- District Innovation

- Customer Service Assessment

- Intellectual Property (IP) Protection and Management

- Support to Creative Industries

- Manufacturing Standards Consultancy Service

- Production Capacity Optimisation

- Cost of Quality

- HKPC Academy

- SME Support

- Funding

- Testing & Standards

- Venues & Facilities

-

Support & Resource

- Technology Transfer

-

Support Centres

- Support Centres

- Future Life and Health Tech Centre & Future FoodTech Lab

- Low-altitude Economy Tech Hall

- The Cradle – Go Global Service Centre

- Agentic AI and Industrial Metaverse Hall

- HKPC-HP 3D Printing Technology Centre

- Future Manufacturing Hall

- Hong Kong Technology and Innovation Support Centre

- Inno Space

- The HATCH

- Advanced Electronics Processing Technology Centre

- Green Living Laboratory

- Reliability Testing Centre

- Electromagnetic Compatibility Centre

- Plastics Technology Centre

- Smart Wearables, Watch & Clock Technology Centre

- Conformal Cooling Technology Centre

- Hong Kong Digital Testing Hub

- Hong Kong Industrial Drone Technology Centre

- Aqua Research Laboratory

- Advanced Materials and Intelligent Manufacturing Centre

- Hong Kong Joint Research Lab for Applications of Intelligent Automation Technology

- Future FoodTech Lab

- HKUST-HKPC Joint Research Lab for Industrial AI and Robotics

- Hong Kong Industrial Artificial Intelligence & Robotics Centre (FLAIR)

- Testing & Standards

- HKPC Spotlights

- About US

-

LANGUAGE

LANGUAGE

HealthTech and Traditional Chinese Medicine

- R&D service and Functional Investigation on Chinese Medicine, Health Food & Wellness product

- Compliance Consultation Service for Chinese Medicine, Pharmaceutical, Health Food and Medical Device Industries

- Manufacturing Enhancement - Automatic Intelligent System for Production and Packaging in Chinese Medicine, Pharmaceutical and Health Food Industries

- Assisting funding application for local medicine and health industrial associations

- “The Cradle” Services for Health Tech and TCM Industry

IIOT

- Industrie 4.0 - Smart Enterprise

- Product Lifecycle Management Consultancy

- Intelligent Automatic Warehousing and Logistics

- Real-Time Manufacturing Tracking System

- Knowledge Based Engineering & CAD Solution

- Location Based Services and Location Analytics

- The HATCH

- Hong Kong Industrial Drone Technology Centre

Advanced Manufacturing Technology

- 3D Scanning and Reverse Engineering Service

- Flexible Metallic Fiber Physical Porous Part Fabrication Technology

- Advanced Mould Cooling Technology and CAE Conformal Cooling Analysis

- Gas Atomisation Technology

- Dual Laser Metal Polishing Technology

- Advanced Additive Manufacturing, 3D Printing Technology, and Direct Manufacturing

- Diffusion Bonding Technology

- Electrically-Assisted Free Forming (EAFF) Technology for Customisation of Sheet Metal Parts

- Plastic Process and Machinery Technology

- Fashion and Garment Technology

- Computer Aided Technology (CAx)

- Watch Assembly Automation Technology

Digital Transformation

- HKPC Digital DIY Portal

- Digital Transformation Support

- Intelligent Integrated Non-wearable and Wearable Health Monitoring System and App for Elderly Homes

- 「FitEasy」Virtual Fitting Technology - For People with Disability

- Smart Solution

- Research and Analytics

- Strategic IT Management

- Embedded Software System

- New Media and Learning Technology Development

- IT Industry Support

- DevOps Maturity Assessment and Consultancy Service

- Software Testing Automation Consultancy Service

- Blockchain Consulting Service

- Extended Reality (XR) technology and consultancy service

Cyber Security

- Cyber Security

- Cybers Security-by-design, Privacy and Compliance-by-default

- Design & Architecture

- Train & Develop

- Offensive Security

- Intelligent Security

- Defensive Security

- Intelligent Hardening

- Internet of Things (IoT) & Operational Technology (OT) Cyber Security Testing

- Phishing Defence Services

- Cyber Security Assessment & Audit

- Cyber Security Consultancy for i4.0 & e4.0

Corporate Sustainability

- ESG and Sustainability Services

- Manufacturing Technology (Tooling, Metals & Plastics) Recognition of Prior Learning (RPL) Mechanism

- Market Research and Analytics

- Business Innovation

- Sustainability-related standards and guidance

- Organisation Innovation Capability Development

- District Innovation

- Customer Service Assessment

- Intellectual Property (IP) Protection and Management

- Support to Creative Industries

- Manufacturing Standards Consultancy Service

- Production Capacity Optimisation

- Cost of Quality

Support Centres

- Future Life and Health Tech Centre & Future FoodTech Lab

- Low-altitude Economy Tech Hall

- The Cradle – Go Global Service Centre

- Agentic AI and Industrial Metaverse Hall

- HKPC-HP 3D Printing Technology Centre

- Future Manufacturing Hall

- Hong Kong Technology and Innovation Support Centre

- Inno Space

- The HATCH

- Advanced Electronics Processing Technology Centre

- Green Living Laboratory

- Reliability Testing Centre

- Electromagnetic Compatibility Centre

- Plastics Technology Centre

- Smart Wearables, Watch & Clock Technology Centre

- Conformal Cooling Technology Centre

- Hong Kong Digital Testing Hub

- Hong Kong Industrial Drone Technology Centre

- Aqua Research Laboratory

- Advanced Materials and Intelligent Manufacturing Centre

- Hong Kong Joint Research Lab for Applications of Intelligent Automation Technology

- Future FoodTech Lab

- HKUST-HKPC Joint Research Lab for Industrial AI and Robotics

- Hong Kong Industrial Artificial Intelligence & Robotics Centre (FLAIR)

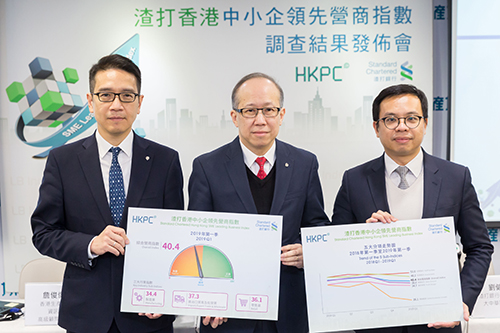

HKPC Announces 2019 Q1 Standard Chartered Hong Kong SME Index: International Trade Tension Continues to Haze SMEs Business Confidence

(Hong Kong, 29 January 2019) The Hong Kong Productivity Council (HKPC) today announced the first quarter result of the "Standard Chartered Hong Kong SME Leading Business Index" (Standard Chartered SME Index). The Overall Index dropped by 2.6, reading at 40.4, which was the same as the low level three years ago. Under the global gloomy economic outlook, local SMEs still lack confidence in doing business.

In the first quarter of 2019, all the five sub-indices* of the Overall Index in the Standard Chartered SME Index dived once again after the drop in the previous quarter. Only the "Staff Number" (51.0) was seen above the neutral level; "Investments" (46.2) dropped by 3.9 and reached a negative level; whilst "Sales Amount" and "Profit Margin" were read at 38.0 and 34.7 respectively, "Global Economy Growth" dropped even further in this quarter to 16.1, seeing its second lowest point ever since the index was launched.

In terms of industry, the three key industry sub-indices all dropped to below 40. The "Import/Export Trade and Wholesale industry" sub-index slightly increased by 0.5 point to 37.3. Respondents expected "Sales Amount" and "Profit Margin" deterioration to get milder, yet "Global Economy Growth" forecast was seen diving to 12.9 - which is the lowest among all industries. "Manufacturing Industry" and "Retail Industry" sub-indices both dropped significantly to the lowest in history, which were read at 34.4 and 36.1 respectively.

Mr Kelvin Lau, Senior Economist of Standard Chartered Hong Kong said, "Our survey confirms that the Hong Kong economy is probably facing one of the weakest starts to a year in a decade. It also shows that the slowdown is widespread in nature, with the retail sub-index also at its record low. While we take comfort from the recent rebound in sentiment towards the outlook of the Renminbi, and the prospect of reopening of upcoming US-China trade negotiations, persistent headwinds from slowing global growth should keep weighing on local sentiment for longer. All these elements make policy support from major governments and centrals even more important; further easing of Fed hike expectations and further stimulus from China would be key to fuelling an eventual recovery in local confidence."

In this quarter, the Standard Chartered SME Index once again explored the views of respondents towards the recent international trade tensions. About 38% of SMEs expressed that international trade tension may impact their business volume, with 14% more of them than that of the last quarter (24%). In terms of industry, more than 40% of the respondents in the three key industries indicated that their business volume has already been affected – two times more respondents than the previous quarter in Manufacturing Industry (50%) and Retail Industry (42%) felt the hit. About 23% of SMEs respondents said that they would consider exploring Southeast Asian markets to get away with international trade tension. In response to the temporary relieve of the trade tensions, nearly half of the SMEs respondents believed that local business environment in Hong Kong will be stable or improved in this quarter. Nonetheless, most SMEs (81%) are not optimistic to the outcomes from the trade negotiations.

Mr Gordon Lo, Director (Business Management) of HKPC, said, "The market starts to see the impact from the international trade tension recently, spreading from imports and exports industry to other industries as well. Although the tension is expected to turn milder, the fluctuating market still shakes SMEs’ business confidence. Some SMEs are moving fast to plot a longer term plan through diversifying markets, which can be learned by their peers. As an effort to provide the industry with useful information in this regard, HKPC recently hosts a series of seminars about Southeast Asian markets, to provide market intelligence to operate business in Thailand, Malaysia, Myanmar or Vietnam. Study missions to these countries will also be held in the near future, to provide first-hand information to interested SMEs."

The Survey of Standard Chartered SME Index for Q1 2019 was conducted from late December 2018 to early January 2019. The survey interviewed 820 local SMEs successfully. The report can be downloaded from the SME One Website (www.smeone.org).

*The five Sub-Indices are "Staff Number", "Investments", "Sales Amount", "Profit Margin" and "Global Economy Growth".

- Ends -

Mr Gordon Lo, Director (Business Management) of HKPC (Center), Mr Kelvin Lau, Senior Economist, Greater China, Standard Chartered Bank (Hong Kong) Limited (Right) and Mr Jimmy Chim, Senior Consultant (Industry Development) of HKPC (Left), announced the first quarter result of the "Standard Chartered Hong Kong SME Leading Business Index" . The Overall Index dropped by 2.6, reading at 40.4, which was the same as the low level three years ago.

Mr Gordon Lo, Director (Business Management) of HKPC (Center), Mr Kelvin Lau, Senior Economist, Greater China, Standard Chartered Bank (Hong Kong) Limited (Right) and Mr Jimmy Chim, Senior Consultant (Industry Development) of HKPC (Left), announced the first quarter result of the "Standard Chartered Hong Kong SME Leading Business Index" . The Overall Index dropped by 2.6, reading at 40.4, which was the same as the low level three years ago.

Share the latest information of HKPC to your inbox

Our Services

Support & Resource

HKPC Spotlights

COPYRIGHT© Hong Kong Productivity Council