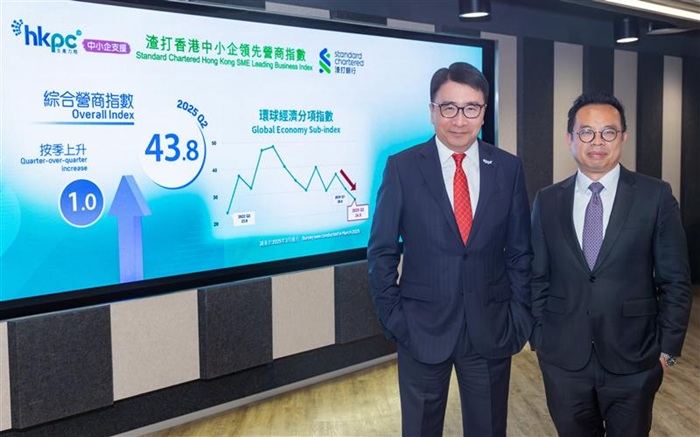

HKPC Announces “Standard Chartered Hong Kong SME Leading Business Index” Q2 2025 Overall Index Remained Stable at 43.8 Global Economy Sub-index Remained Sluggish Trade Industry Under Significant Pressure Digital Transformation and Global Expansion Key to Navigating Challenges

(Hong Kong, 29 April 2025) The Hong Kong Productivity Council (HKPC) today announced the “Standard Chartered Hong Kong SME Leading Business Index” (“Standard Chartered SME Index”) for the second quarter (Q2) of 2025. The survey results indicated that the Overall Index slightly increased by 1.0 to 43.8 from the previous quarter, on par with the levels observed in recent quarters, reflecting that local SMEs remain conservative under the uncertain global economic conditions. Three of the five component sub-indices1 showed improvements, including “Business Condition” (41.6, +3.7), “Profit Margin” (39.1, +3.6) and “Investment Sentiment” (49.9, +0.3). Conversely, “Global Economy” (24.9, -4.7) and “Recruitment Sentiment” (50.7, -0.1) recorded declines.

“Global Economy” sub-index further declined by 4.7 to 24.9 this quarter and returned to a level like Q2 2022, reflecting that the ongoing global trade tensions continued to pose challenges for local SMEs. In particular, the Global Economy sub index of “Import/Export Trade and Wholesale”, “Manufacturing” and “Professional and Business Services” recorded the largest declines, dropping by 8.1, 7.9 and 7.8 points respectively, nearly falling to the levels observed in Q1 2021.

“Standard Chartered SME Index” Survey Results

Among the 11 industry indices, “Financing and Insurance” (52.7, +6.6) recorded the largest growth. Conversely, “Information and Communications” (44.1, -5.7), “Real Estate” (42.5, -2.5) and “Accommodation and Food Services” (41.2, -2.3) experienced more significant declines.

In terms of overall investment trends, 94% of surveyed SMEs intended to maintain or increase investment this quarter, like the previous quarter. Key areas that most SMEs expected to maintain or increase investment included “Online Marketing Promotion”, “Training Related to E-commerce or Digital Technology”, “IT Systems”, “Research and Development” and “Overall Staff Training”.

Regarding the changes in cost components, SMEs anticipated a slowdown in the rise of costs. Specifically, 54% of SMEs expected an increase in raw material costs this quarter, a decrease of 3 percentage points from the previous quarter. Meanwhile, the proportion of SMEs expecting an increase in staff salary dropped by 7 percentage points to 20%. On the other hand, only 17% of SMEs planned to increase the prices of their products or services, a decline of 3 percentage points from the previous quarter.

Dr Lawrence CHEUNG, Chief Technology Officer of HKPC, said, “Amid ongoing actions from the U.S. on many countries, particularly China, regarding trade issues and reciprocal or even higher tariffs, both the political and business sectors are closely monitoring the impact of the U.S. fluctuating trade policies on Hong Kong's economy. Although SMEs are more cautious about the global economic outlook and confidence compared to the previous quarter, the percentage of SMEs anticipating rising costs has slightly decreased this quarter. However, more than half of the SMEs still expected an increase in raw material costs, indicating that the confidence of SMEs in the global economic environment remains subdued. Enterprises are looking to expand e-commerce operations and implement digitalisation measures as cost-effective ways to reach more customers, thereby mitigating the negative impacts of U.S. trade tensions.”

Mr Kelvin LAU, Senior Economist, Greater China and North Asia, Standard Chartered, said, “The ‘Standard Chartered SME Index’ in Q2 2025 confirmed that the Hong Kong economy remained on an improving trend ahead of Trump’s announcement of new tariff policies in April. The Q2 rise in the headline index, albeit a modest one and from a very low base, suggested that our SME respondents weathered a further deterioration in external economic conditions. More specifically, a rebound in our ‘Business Condition’ (+3.7) and ‘Profit Margin’ (+3.6) sub-indices helped offset another hit to the ‘Global Economy’ sub-index (-4.7); the latter likely reflected the impact from initial rounds of US tariff hikes (10%+10%) on China. More worrying is the continued underperformance of some of the more domestic-oriented sectors, including ‘Retail’ and ‘Construction’ – a reminder that they are not ready to take up the slack from an impending export slowdown. All this calls for more policy support to help SMEs better handle growing demand and cashflow uncertainty.”

Thematic Survey Results

The thematic survey results in this quarter explored the strategies for local SMEs in face of future business environment. Amid current uncertainties in the trade environment, nearly 80 percent (78%) of the surveyed SMEs indicated that they have various development plans for the coming year to mitigate existing risks, primarily focusing on “Increasing local customer base” (47%) and “Enhancing AI / digital applications in operational processes” (27%). When segmented by industry, a greater proportion of SMEs in “Manufacturing” planned to “Allocate more resources to develop other markets” (43%) in the coming year, while those in “Import / export trade and wholesale” primarily considered “Increase local customer base” (33%).

Regarding market expansion, nearly 30 percent (29%) of the surveyed SMEs were considering expanding their business to other regions within the next three years, a seven percentage point increase from the previous quarter, reflecting a growing intention from local SMEs to venture abroad. Among these, a significant number of SMEs were still considering expansion into the Mainland (14%) or ASEAN regions (10%), both up by 3 percentage points from the previous quarter.

Dr CHEUNG continued, “In light of the current unstable trade environment, Hong Kong, as a small and outward-oriented economy, is inevitably affected. The recent Government data shows an acceleration in the value of goods exports, with increases recorded in exports to several major markets, including the Mainland and ASEAN. SMEs this quarter, particularly the manufacturing industry, are looking to ‘allocate more resources to develop other markets’ over the next year to mitigate the risks of economic downturn. This reflects a strong recognition that diversifying markets and exploring new customer sources can effectively enhance the resilience of enterprises in facing economic crises. HKPC is committed to leveraging Hong Kong's connectivity to the world and actively meeting the needs of SMEs seeking to expand globally. The newly established ‘The Cradle - Going Global Service Centre’ provides local and the Mainland SMEs with one-stop support and services. Its offerings include assistance with product, technology, manufacturing and business operation globalization, thereby comprehensively supporting enterprises in expanding into more overseas markets.”

Conducted in March 2025, the Standard Chartered SME Index Q2 2025 survey successfully interviewed 817 local SMEs. The report will be available for download from HKPC website: https://www.hkpc.org/en/about-us/hkpc-publication/industry-insight/scbi

1The five sub-indices include “Recruitment Sentiment”, “Investment Sentiment”, “Business Condition”, “Profit Margin” and “Global Economy”.

- Ends -

At the press conference of Standard Chartered Hong Kong SME Leading Business Index Q2 2025, Dr Lawrence CHEUNG, Chief Technology Officer of HKPC (left) and Mr Kelvin LAU, Senior Economist, Greater China and North Asia, Standard Chartered (right) announced that the Overall Index for this quarter was 43.8, with the “Global Economy” sub-index fell to a level similar to Q2 2022.

At the press conference of Standard Chartered Hong Kong SME Leading Business Index Q2 2025, Dr Lawrence CHEUNG, Chief Technology Officer of HKPC (left) and Mr Kelvin LAU, Senior Economist, Greater China and North Asia, Standard Chartered (right) announced that the Overall Index for this quarter was 43.8, with the “Global Economy” sub-index fell to a level similar to Q2 2022.

Share the latest information of HKPC to your inbox

LANGUAGE

LANGUAGE