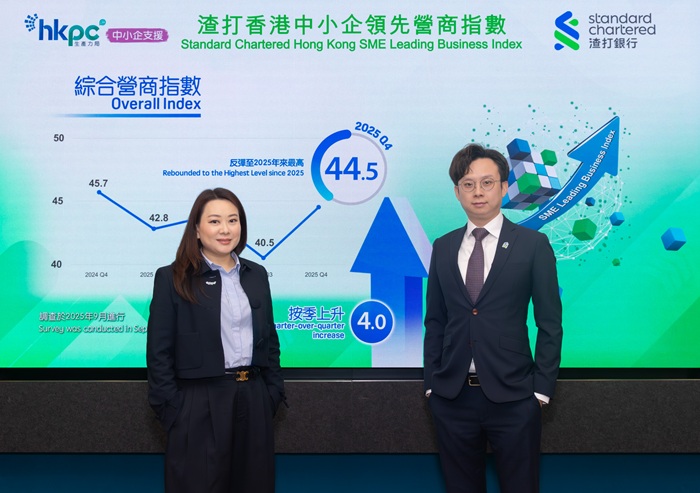

HKPC Releases “Standard Chartered Hong Kong SME Leading Business Index” Q4 2025 Overall Index Rebounded 4.0 to a New High of 44.5 Upskills to Go Global: SMEs Need to Strengthen Sales, Operations and Regulatory Capabilities

(Hong Kong, 20 October 2025) The Hong Kong Productivity Council (HKPC) today announced the “Standard Chartered Hong Kong SME Leading Business Index”(“Standard Chartered SME Index”) for the fourth quarter (Q4) of 2025. The survey results indicated that the Overall Index has reached new heights in 2025, reflecting a significant recovery in SMEs’ confidence in the business environment. All five component sub-indices1 rose this quarter, with the “Global Economy” sub-index rebounding strongly (32.6, +12.0) after three consecutive quarters of decline, returning to a level close to that of Q4 2024. “Profit Margin” (39.0) and “Business Condition” (40.6) sub-indices also increased by 4.9 and 4.0 respectively. Meanwhile, “Recruitment Sentiment” (50.7, +2.0) and “Investment Sentiment” (50.4, +2.0) recorded slight increases and both returned to the 50 neutral line, indicating that enterprises were actively preparing for future business development.

“Standard Chartered SME Index” Survey Results

Among the 11 industry indices, only “Construction” recorded a slight decline, while the remaining 10 industry indices recorded increases. In particular, “Real Estate” (46.0, +7.5), “Financing and Insurance” (49.2, +6.2), “Transportation, Storage and Courier Services” (40.4, +6.1) and “Retail” (43.5, +6.0) experienced more significant growth.

Regarding the changes in cost components, SMEs anticipated a continued slowdown in the rise of costs. Specifically, 46% of SMEs expected an increase in raw material costs this quarter, a decrease of 1 percentage point from the previous quarter. Meanwhile, the proportion of SMEs expecting an increase in staff salary dropped 3 percentage points to 16%. On the other hand, only 16% of SMEs planned to increase the prices of their products or services, a decline of 1 percentage point from the previous quarter.

In terms of overall investment trends, 95% of surveyed SMEs intended to maintain or increase their investment this quarter, an increase of 3 percentage points from the previous quarter, with 6% specifically stating that they would increase their investment. The areas that most SMEs expected to increase investment included “IT System”, “Facilities and Equipment”, “Training Related to E-commerce or Digital Technology”, “Overall Staff Training” and “Online Marketing Promotion”.

Mr Hunter CHAN, Economist, Greater China, Standard Chartered, said, “The ‘Standard Chartered SME Index’ rebounded to a year-to-date high of 44.5 in Q4 after falling to a 13-quarter low of 40.5 in Q3. A sharp recovery in the ‘Global Economy’ (+12.0) sub-index was a key contributor. Long-term SME business sentiment appears to have stabilised: both the ‘Recruitment Sentiment’ and ‘Investment Sentiment’ sub-indices entered expansionary territory, with ‘Investment Sentiment’ posting its first above-50-neutral-line reading since Q3 2023. However, short-term headwinds persist, going by SMEs’ responses — the ‘Business Condition’ and ‘Profit Margin’ sub-indices stayed low at around 40, despite a quarter-over-quarter recovery. Meanwhile, ‘Import/Export Trade and Wholesale’ and ‘Transportation, Storage and Courier Services’ ranked low in terms of industry indices. This suggests that while ongoing US-China trade talks reduced tensions during the survey period, latest negotiations over rare earths and shipping issues in October indicated that trade uncertainty persisted and would continue to be a major factor affecting SME confidence.”

Thematic Survey Results

The thematic survey of this quarter explored local SMEs’ views on expanding cross-border business. The survey revealed that 20% of the surveyed SMEs have already planned to expand business to other regions within the next year, with a majority preferring to expand into the Chinese Mainland (57%) or Asian markets (47%).

Among SMEs currently operating or planning to expand into cross-border business within the next year, 85% indicated that they primarily relied on their own funds for expansion, while a smaller proportion depended on business financing/loans (20%), investor funding (19%), or government subsidies/funding (17%). In terms of modes of operation, “agent or distributor model” and “direct export of products or services” were the most common, followed by “establishing an overseas company or office” and “collaborating with local businesses”. Additionally, when establishing local partnerships, SMEs mainly relied on recommendations from existing customers or network (63%), collaboration with local agents or distributors (49%), and engagement in local exhibitions or networking events (39%). When it comes to operating cross-border business, nearly half of the SMEs (48%) believed “sales channels” was the most critical area to strengthen, followed by “platform operations” (33%), “overseas regulations” (33%), “human resources” (31%), and “cross-border marketing” (29%).

On the other hand, some SMEs still had no plans to expand cross-border business. The main reasons included a lack of relevant manpower or professional team, high costs and significant financial pressure, complex legal, tax, or compliance issues, unfamiliarity with overseas markets and lack of confidence, and the belief that there is still growth potential in existing markets, thus no immediate demand.

Ms Karen FUNG, Chief Marketing Officer of HKPC, said, “The thematic findings reflected that expanding cross-border business had been a key direction for many SMEs, but they had faced challenges in sales channels, platform operations, and adapting to regulations. This is precisely where HKPC focuses its support. We are committed to providing diverse assistance to SMEs and have integrated a range of offers and support measures for them, including six key services and offers. Among these offerings, HKPC Academy—committed to cultivating FutureSkills talent—is spearheading the ‘New Productive Forces Talent Programme’, funded by the Innovation and Technology Commission, with the objective of fostering a pipeline of tech professionals and entrepreneurs who possess cutting-edge skills and an innovative mindset. To further support SMEs in upskilling their workforce, a dedicated “Buy 1 Get 9 Free” promotion for online training courses has been introduced, covering a range of in-demand topics, including ESG, cloud computing, cybersecurity, and artificial intelligence. In addition, we fully support the Government's 'GoGlobal Task Force' by helping to build a robust support ecosystem for enterprises, providing end-to-end assistance from technical challenges and scenario testing to alignment with international regulations. We encourage SMEs to utilise Government fundings and expert services to methodically develop their cross-border operations”.

Ms FUNG continued, pointing out that HKPC and the Trade and Industry Department recently held the fifth annual event “SME ReachOut: FUND Fair plus Tech Sourcing 2025” with success. Featuring “FUND Tech Go”, the event directly addressed the core challenges local enterprises faced in digital transformation and overseas market expansion, especially when resources were limited. The event brought together over 80 funding organisations and technology exhibitors, providing SMEs with a one-stop solution. Not only did it help them grasp key trends such as AI and cross-border e-commerce, but it also featured special guest speakers from the Chinese Mainland and ASEAN business communities sharing their practical experiences, directly empowering SMEs to accurately position themselves in the “Belt and Road Initiative” and emerging markets. This event demonstrated HKPC’s ongoing commitment to helping SMEs overcome the obstacles of going global and enabling their transformation and upgrading.

Conducted in September 2025, the Standard Chartered SME Index Q4 2025 survey successfully interviewed 818 local SMEs. The report will be available for download from HKPC website: https://www.hkpc.org/en/about-us/hkpc-publication/industry-insight/scbi.

1The five sub-indices include “Recruitment Sentiment”, “Investment Sentiment”, “Business Condition”, “Profit Margin” and “Global Economy”.

- Ends -

At the press conference of Standard Chartered Hong Kong SME Leading Business Index Q4 2025, Ms Karen FUNG, Chief Marketing Officer of HKPC (left) and Mr Hunter CHAN, Economist, Greater China, Standard Chartered (right) announced that the Overall Index rose by 4.0 to 44.5 from the previous quarter.

At the press conference of Standard Chartered Hong Kong SME Leading Business Index Q4 2025, Ms Karen FUNG, Chief Marketing Officer of HKPC (left) and Mr Hunter CHAN, Economist, Greater China, Standard Chartered (right) announced that the Overall Index rose by 4.0 to 44.5 from the previous quarter.

Share the latest information of HKPC to your inbox

LANGUAGE

LANGUAGE