DHL Hong Kong Air Trade Leading Index (DTI)

DHL Hong Kong Air Trade Leading Index ("DTI") is a quarterly survey implemented by the Hong Kong Productivity Council ("HKPC"), and commissioned by DHL Express (Hong Kong) Limited ("DHL").

DTI is the first-of-its-kind in Hong Kong, offering publicly available market intelligence for local enterprises, especially SMEs which typically have limited resources or access to information, enabling all to take reference from a comprehensive business review of the sector in which they operate.

The Overall Index represents the air trade market outlook for the surveying quarter, in respect of import and (re-)export. The research also studies the underlying trends in business attributes, markets and air-freighted commodities, thus assisting local enterprises in arriving at a primed view of the business outlook of their markets.

DTI – First Quarter of 2026

Release Date: 8 Jan, 2026

REPORT SUMMARY

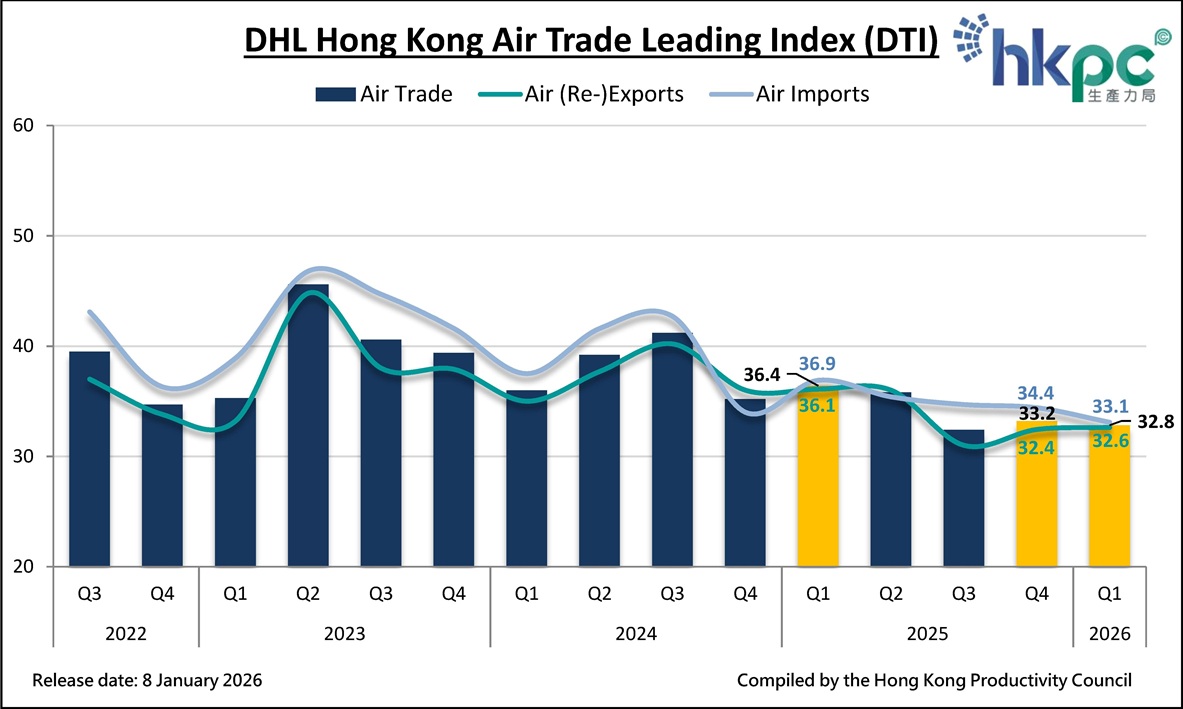

Air trade shows resilience as the Overall Air Trade Index remains stable in early 2026, signalling strength despite global economic headwinds and rising trade tensions. Seasonal demand is expected to lift shipments, with cautious optimism prevailing. The Chinese Mainland leads growth prospects, while Southeast Asia emerges as a key expansion opportunity.

- The Overall Air Trade Index held steady at 32.8 in the first quarter of 2026, reflecting resilience and alignment with recent performance (Q4 2025: 33.2; Q3 2025: 32.4). This stability underscores air traders' continued confidence, even amid prevailing external uncertainties.

- Across regions, the Europe index reflects positive growth momentum, while Asia Pacific faces certain challenges. With Chinese New Year approaching, seasonal demand is expected to rise, particularly for Apparel & Clothing Accessories as well as Gifts, Toys, and Houseware products.

- During the traditional peak season in Q4 2025, air traders' performance largely aligned with expectations, with 55% reporting outcomes consistent with expectations. However, 42% fell short of projections, while only 3% surpassed expectations, underscoring the complexities of the current operating environment.

- Weak global economic conditions and low consumer demand remain top concerns for 2026, compounded by rising China–US trade tensions, and persistently high logistics costs that continue to squeeze operational margins.

- In response, the majority of air traders (73%) intend to maintain their 2026 pricing at 2025 levels. Meanwhile, 18% plan to implement price increases. Within this group, 50% anticipate adjustments of 3% - 6%, 28% expect increases above 6%, and 23% will apply more modest changes of less than 3%.

- The Chinese Mainland is recognised as the leading market with the greatest growth potential. Southeast Asian economies—including Vietnam (18%), Thailand (14%), Malaysia (12%), and Singapore (11%)—are identified as attractive secondary markets for business expansion.

Mr Edmond LAI, Chief Digital Officer of HKPC, commented, “Air trade is expected to remain stable in Q1 2026, with (re-)exports continuing their upward trajectory and Europe reinforcing its position as the leading market. While Asia Pacific may face short-term challenges, the outlook for 2026 remains promising, driven by strong potential in the Chinese Mainland and emerging opportunities across Southeast Asia. The strength in product variety and shipment urgency highlights traders’ agility to meet diverse and time-sensitive demand.

Looking ahead, air traders anticipate a steady pricing environment and are preparing to capture growth in key.”

Download the latest report of DTI (PDF version) (Text-only version).

Download of DTI Quarterly Report

Methodology

Index Calculation: Index = [100 x (Percentage of samples responding "Positive") ] + [50 x (Percentage of samples responding "Neutral") ] + [0 x (Percentage of samples responding "Negative") ]

Readings

- Ratios of collected responses are used to form the indices.

- An index value above 50 indicates an overall positive outlook while a reading below 50 represents an overall negative outlook for the surveyed quarter.

- The further the reading is from 50, the more positive or negative the outlook is.

Demographics

- Respondents are Hong Kong-based companies with either inbound or outbound air trade. It includes Watches, Clocks & Jewellery, Apparel & Clothing Accessories, Electronic Products & Parts, Gifts, Toys & Houseware, Food & Beverage and Others (including courier items and other items that do not belong to the categories listed above).

- Over 600 samples are collected in each quarter.

- Sample companies are randomly selected from publicly available directories.

Disclaimer

This report contains survey result based on research findings. HKPC will not be liable for any loss, mistake, delay, action or non-action by viewers of this report.

Enquiry

For more details about the Index, please contact HKPC at tel. (852) 2788 5306.

Share the latest information of HKPC to your inbox

LANGUAGE

LANGUAGE