DHL Hong Kong Air Trade Leading Index (DTI)

DHL Hong Kong Air Trade Leading Index ("DTI") is a quarterly survey implemented by the Hong Kong Productivity Council ("HKPC"), and commissioned by DHL Express (Hong Kong) Limited ("DHL").

DTI is the first-of-its-kind in Hong Kong, offering publicly available market intelligence for laocal enterprises, especially SMEs which typically have limited resources or access to information, enabling all to take reference from a comprehensive business review of the sector in which they operate.

The Overall Index represents the air trade market outlook for the surveying quarter, in respect of import and (re-)export. The research also studies the underlying trends in business attributes, markets and air-freighted commodities, thus assisting local enterprises in arriving at a primed view of the business outlook of their markets.

DTI – Second Quarter of 2025

Release Date: 10 Apr, 2025

REPORT SUMMARY

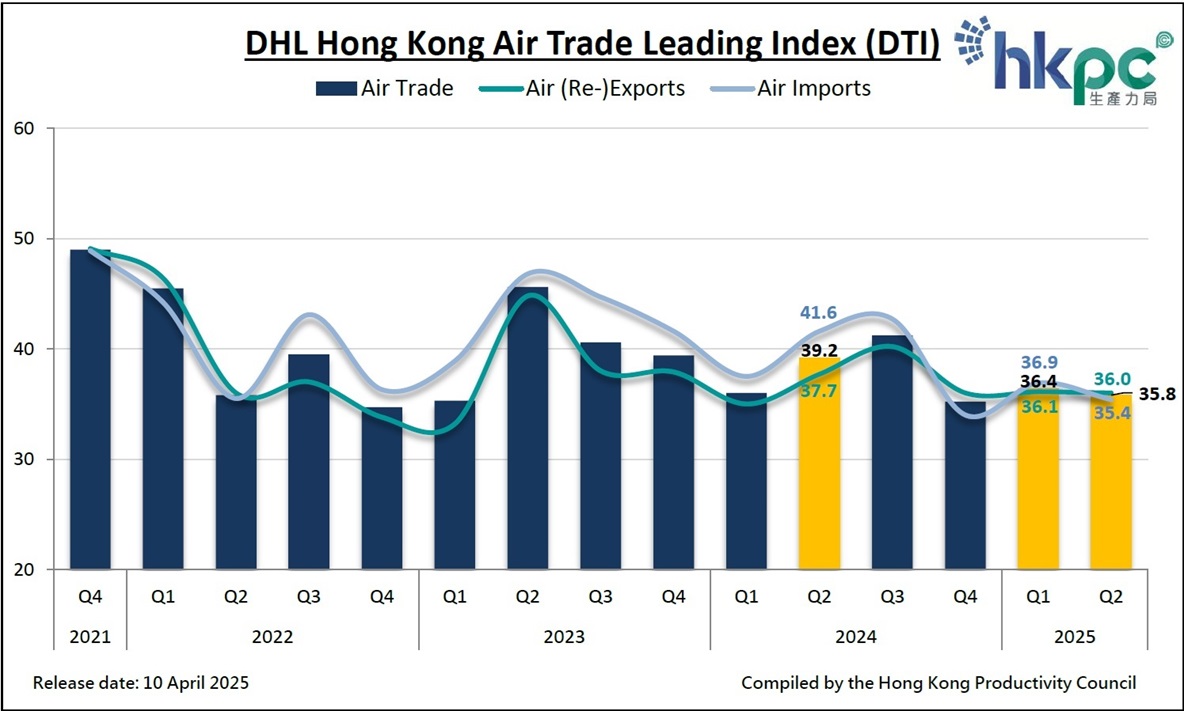

The Overall Air Trade Index remains consistent, reflecting a cautious 'wait and see' approach among local air traders amid an uncertain trade environment.

- Despite a slight decline, the Overall Air Trade Index remains comparable to the previous quarter, largely attributed to the volatile global trade landscape.

- The index for the Americas continues to be consistently low and on par with the previous quarter, while signs of improvement are observed in the Europe market.

- In response to the additional tariffs imposed by the US and the potential cancellation of de-minimis exemption, more than 50% of local air traders plan to pass these additional costs onto customers, while approximately 40% indicating that they will share the burden with customers.

- Despite the evolving dynamics of US trade policies, 90% of air traders who focused on markets outside the US do not anticipate an increase in orders.

- Given the continually changing US trade policy, Southeast Asia is identified as the most promising market (29%), followed by Europe at 19%.

- A growing commitment to sustainability is evident, with an increasing percentage of local air traders expressing their willingness to engage in ‘Go Green’ initiatives, reaching 78% this quarter, which signifies a positive step towards reducing carbon emissions.

Mr Edmond LAI, Chief Digital Officer of HKPC, commented, “The air trade index settled at 35.8 points in Q2 2025, maintaining a similar level since the last quarter of 2024, reflecting that the confidence among air traders remains subdued. Market indices in Q2 2025 generally fell short of the levels observed in Q2 2024, particularly in Asia Pacific and the Americas. Amidst the ever-changing trade policies in the US under the new presidency, the Americas index remained at its lowest level in the past three years (31 points), highlighting that considerable uncertainties continue to surround the long-term implications for air traders. Additional tariffs from the US have driven over 50% of local air traders to pass these costs onto customers, while approximately 40% plan to share the burden.

To navigate this dynamic landscape, air traders are advised to explore alternative markets to reduce reliance on a single market, diversify supply chains, and invest in technology to enhance resilience and adaptability.”

Download the latest report of DTI (PDF version) (Text-only version).

Download of DTI Quarterly Report

Methodology

Index Calculation: Index = [100 x (Percentage of samples responding "Positive") ] + [50 x (Percentage of samples responding "Neutral") ] + [0 x (Percentage of samples responding "Negative") ]

Readings

- Ratios of collected responses are used to form the indices.

- An index value above 50 indicates an overall positive outlook while a reading below 50 represents an overall negative outlook for the surveyed quarter.

- The further the reading is from 50, the more positive or negative the outlook is.

Demographics

- Respondents are Hong Kong-based companies with either inbound or outbound air trade. It includes Watches, Clocks & Jewellery, Apparel & Clothing Accessories, Electronic Products & Parts, Gifts, Toys & Houseware, Food & Beverage and Others (including courier items and other items that do not belong to the categories listed above).

- Over 600 samples are collected in each quarter.

- Sample companies are randomly selected from publicly available directories.

Disclaimer

This report contains survey result based on research findings. HKPC will not be liable for any loss, mistake, delay, action or non-action by viewers of this report.

Enquiry

For more details about the Index, please contact HKPC at tel. (852) 2788 5306.

Share the latest information of HKPC to your inbox

LANGUAGE

LANGUAGE