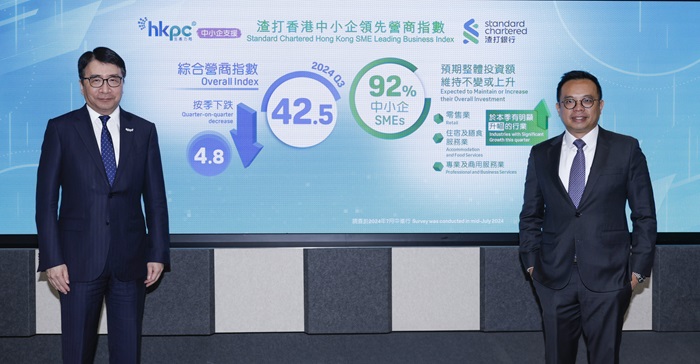

“HKPC SME Support” Announces “Standard Chartered Hong Kong SME Leading Business Index” Q3 2024 Overall Index Retreated by 4.8 to 42.5 The Overall Investment Sentiment Remains Steady

(Hong Kong, 13 August 2024) “HKPC SME Support” today announced the “Standard Chartered Hong Kong SME Leading Business Index” (“Standard Chartered SME Index”) for the third quarter (Q3) of 2024. The Overall Index retreated by 4.8 to 42.5, reaching the lowest level since Q3 2022. All the five component sub-indices1 recorded a decline in this quarter, in which "Global Economy" (29.5, -9.9), "Profit Margin" (35.1, -8.3) and "Business Condition" (39.4, -8.0) recorded a significant decline, reflecting a drop in business turnover among Hong Kong SMEs for this quarter.

“Standard Chartered SME Index” Survey Results

In terms of the 11 industry indices, only "Construction" recorded a slight increment of 1.8, while the remaining 10 industry indices recorded declines. Among those, "Real Estate", which had an increment of more than 10 in the last quarter, dropped 15 to 37.3 in Q3. In addition, “Information and Communications” (47.9) and “Financing and Insurance” (44.2) recorded a decline of 9.8 and 7.5 respectively, dropping below the 50 neutral line.

In terms of overall investment trends, 92% of the surveyed SMEs indicated that they would maintain or increase investment this quarter, which is on par with the previous quarter. The industries with the highest proportions were "Accommodation and Food Services" (98%), "Social and Personal Services" (98%), "Professional and Business Services" (96%), "Financing and Insurance" (94%) and "Retail" (93%). The areas that most SMEs expected to maintain or increase investment were "Research and Development", "Training Related to E-Commerce or Digital Technology", "Overall Staff Training", "Facilities and Equipment", "Offline Marketing Promotion" and "IT System". Notably, "Retail", "Accommodation and Food Services" and "Professional and Business Services" showed significant growth in this quarter.

In terms of the changes in cost components, the proportion of local SMEs expecting raw materials cost to increase had been dropped by 6 percentage points to 57%. Similarly, the proportion of SMEs expecting an increase in staff salary fell by 3 percentage points to 27%. The findings indicate a slowdown in the cost pressures facing SMEs. On the other hand, only 19% of SMEs planned to increase the price of their product or service, a decrease of 4 percentage points from the previous quarter, indicating that most SMEs are gradually easing the pace of their price increases.

Mr Kelvin LAU, Senior Economist, Greater China, Global Research, Standard Chartered Bank (Hong Kong) Limited, said, “The latest survey results has shown that local SME business sentiment remains weak, and the risk is for such pessimism may continue in view of more challenges ahead, weighing on Hong Kong’s growth prospects in the second half of this year. Externally, we believe the sub-30 level for ‘Global Economy’ sub-index reflects respondents remaining cautious on the uncertainty from US election and renewed China slowdown. Domestically, ‘Accommodation and Food Services’, ‘Retail’ and ‘Real Estate’ have been the three biggest industry underperformers since the Standard Chartered SME Index peaked in Q2 2023 on a short-lived reopening boost. Given such a broad-based setback, a moderate increase in cost and the impending US rate cutting cycle could only offer short-term relief in our view.”

Thematic Survey Results

The thematic survey of this quarter investigated the impact of high interest rate environment on Hong Kong SMEs. The survey revealed that over half (56%) of the surveyed SMEs expressed that the high interest rate environment has led to reduction of customers' purchasing power, particularly in “Retail”, “Accommodation and Food Services”, and “Real Estate”. However, three quarters (75%) of SMEs stated that they did not reduce investments due to the high interest rate environment, indicating that the decline in customers’ purchasing power did not affect SMEs' investment plans.

In terms of operation, 29% of the surveyed SMEs indicated that the high interest rate environment has negatively impacted their supply chain management as they “need to find suppliers offering lower prices”, “reduce inventory to reduce costs”, and “increase in inventory costs”. On the other hand, around one third (32%) of the surveyed SMEs indicated that the high interest rate environment had a negative impact on cash flow, primarily because of “customers delaying payments”, “declining sales”, and “rising costs of existing debts”.

In terms of financing, nearly one-fifth (18%) of the surveyed SMEs reported difficulties in borrowing or obtaining new funds. “Tightening of lending conditions”, “banks raising lending rates”, and “reduction in credit limits” are their difficulties in obtaining new funds.

Dr Lawrence CHEUNG, Chief Innovation Officer of HKPC, said, the economic recovery in Hong Kong in the third quarter is slower than expected. Over half of the surveyed SMEs reported a decrease in customers’ purchasing power, particularly impacting the tertiary sectors, like service industry. Despite this, a staggering 92% of SMEs still planned to maintain or increase their overall investments. Furthermore, around 20% of the surveyed SMEs expressed difficulties in borrowing or obtaining new funds. To support SMEs in financing, the Hong Kong Monetary Authority previously introduced the "Banking Sector SME Lending Coordination Mechanism", which believed to stabilise the credit market and assist SMEs in seizing opportunities to expand their businesses. He emphasised, “SMEs should actively consider utilising relevant funding programmes provided by the HKSAR Government. For example, the ‘BUD Fund’ administered by the HKPC has continuously introduced optimisation measures. In June 2023, they launched ‘Easy BUD’ to expedite the application process, allowing more SMEs to utilise subsidies for business development. In July, we also introduced ’E-commerce Easy’, providing HKD 1 million funding to assist SMEs seizing e-commerce opportunities and promoting products in the mainland and other overseas markets."

The survey also explored the future deployment plan of SMEs under the high interest rate environment. In the short term (in the next 6 months), a higher percentage of SMEs indicated that they would be "adjusting product/ service pricing" (29%), "cutting costs" (23%) and "diversifying supply sources" (22%). In the long term (in the next 7 to 12 months), more SMEs stated that they would be "enhancing risk management to address economic volatility" (26%), "reinventing business model" (17%), and "increasing financial reserves" (16%).

Dr CHEUNG continued, “Despite the uncertain market environment, overall demand remains strong. Coupled with Hong Kong's international business environment and the unique advantage of high flexibility for SMEs, along with all-round support from the HKSAR Government in funding and technology, there is potential for new breakthroughs in business. HKPC is committed to promoting the digitalisation of Hong Kong's SMEs to enhance their competitiveness. Our all-in-one platform, 'Digital DIY Portal', allows SME users to connect with major technology partners and offers more than 250 diverse, cost-effective, and efficient cloud solutions as well as entry-level digital packages. This facilitates SMEs in easily implementing digital transformation and launching products that meet the needs of various market segments and customers.”

Looking ahead, SMEs generally expected that an interest rate downcycle would begin shortly. Among them, 34% of the surveyed SMEs expected the interest rate downcycle to begin “within 6 months”, 27% anticipated it “within 7 - 12 months", while 26% expected it to occur “one year or later”, and the remaining 13% expressed “don’t know”. When the interest rate downcycle begins, a higher percentage of SMEs planned to "adjust product/ service pricing" (25%) and "adjust investment strategies" (14%), while over half (55%) stated that “no change will be made”.

Conducted in July 2024, the Standard Chartered SME Index Q3 2024 survey successfully interviewed 814 local SMEs. The report will be available for download from HKPC website: https://www.hkpc.org/en/about-us/hkpc-publication/industry-insight/scbi.

To learn more about HKPC’s smart solutions to help enhance the productivity of SMEs with advanced technology, please visit the dedicated webpage: https://smarter.hkpc.org.

1The five sub-indices include “Recruitment Sentiment”, “Investment Sentiment”, “Business Condition”, “Profit Margin” and “Global Economy”.

- Ends -

At the Press Conference of the “Standard Chartered SME Index” Q3 2024, Dr Lawrence CHEUNG, Chief Innovation Officer of HKPC (left) and Mr Kelvin LAU, Senior Economist, Greater China, Global Research, Standard Chartered Hong Kong (right) announced that the Overall Index retreated by 4.8 to 42.5 this quarter.

At the Press Conference of the “Standard Chartered SME Index” Q3 2024, Dr Lawrence CHEUNG, Chief Innovation Officer of HKPC (left) and Mr Kelvin LAU, Senior Economist, Greater China, Global Research, Standard Chartered Hong Kong (right) announced that the Overall Index retreated by 4.8 to 42.5 this quarter.

Share the latest information of HKPC to your inbox

LANGUAGE

LANGUAGE