DHL Hong Kong Air Trade Leading Index (DTI)

DHL Hong Kong Air Trade Leading Index ("DTI") is a quarterly survey implemented by the Hong Kong Productivity Council ("HKPC"), and commissioned by DHL Express (Hong Kong) Limited ("DHL").

DTI is the first-of-its-kind in Hong Kong, offering publicly available market intelligence for local enterprises, especially SMEs which typically have limited resources or access to information, enabling all to take reference from a comprehensive business review of the sector in which they operate.

The Overall Index represents the air trade market outlook for the surveying quarter, in respect of import and (re-)export. The research also studies the underlying trends in business attributes, markets and air-freighted commodities, thus assisting local enterprises in arriving at a primed view of the business outlook of their markets.

DTI – Fourth Quarter of 2025

Release Date: 9 Oct, 2025

REPORT SUMMARY

Overall Air Trade Index Reflects Recovery: Improved Confidence in Americas, Strong B2C Momentum, and Proactive Trader Strategies Foster Cautious Optimism for Peak Season.

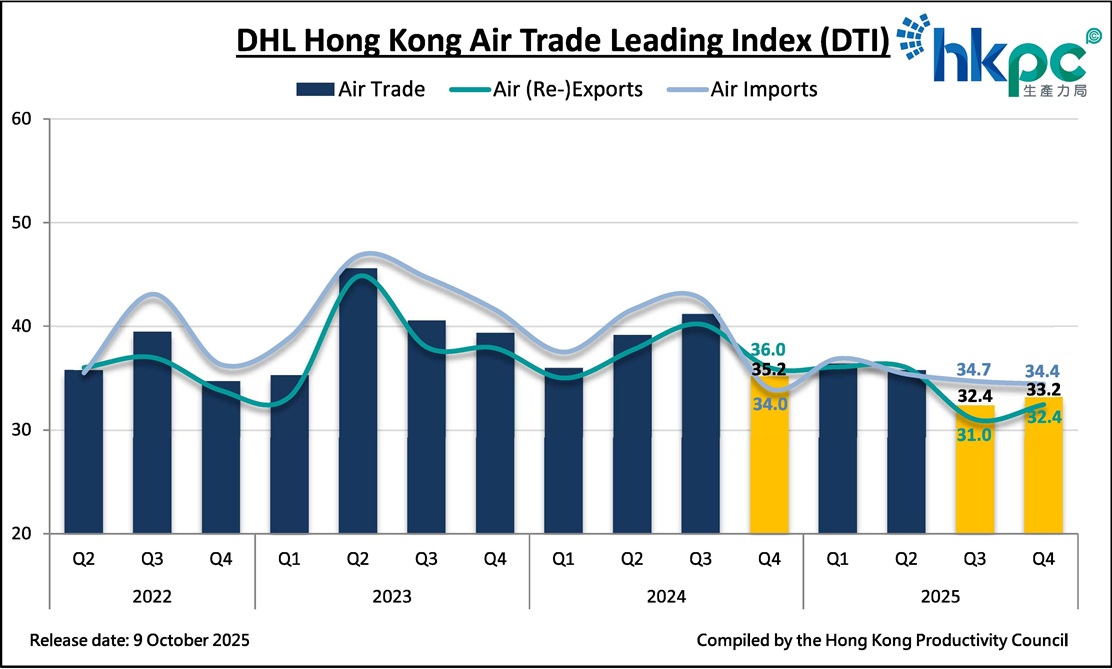

- The Overall Air Trade Index experiences a modest uptick to 33.2, signaling a welcome halt to the recent downward trend. This suggests that market sentiment is bottoming out and showing signs of recovery.

- Among regions, the Americas index records a slight improvement, rising 2 points to 30.

- The Online B2C Index demonstrates notable performance in this quarter, climbing from 34.3 to 36.1, largely driven by the growth in Online Product Variety.

- Looking ahead to peak season, sentiment remains cautiously optimistic. 67% of air traders expect shipment volumes to either remain stable (48%) or increase (19%), reflecting expectations for sustained business activity.

- In response to the need for greater resilience and cost management, nearly a quarter of air traders (23%) who have exported to Americas are now consolidating their shipments, showcasing a pragmatic approach to navigating the current trade environment.

- Forward-looking air traders are exploring new growth destinations, with nearly 18% of those who have exported to Americas shifting shipments to emerging markets. Southeast Asia stands out as the primary destination (43% of those planning to diversify), underscoring a strategic pivot towards regional opportunities.

- Over the past two years, there has been a steady rise in the proportion of air traders prioritising carbon emission reductions, highlighting a significant shift in industry mindset and a growing commitment to sustainable practices.

Mr Edmond LAI, Chief Digital Officer of HKPC, commented, “The Air Trade Index marks a significant point for the industry as we observe initial signs of stabilisation after an extended period of uncertainty. The shifts in key markets, particularly the Americas and Southeast Asia, demonstrate the sector’s resilience and ability to adapt in challenging circumstances. Notably, the recent implementation of reciprocal tariffs and the elimination of De Minimis exemption on shipments from the Chinese Mainland and Hong Kong in the US are reshaping trade dynamics, prompting traders to reassess supply chain strategies and market access.

There is a noticeable increase in the emphasis on sustainability, with more enterprises prioritising carbon emission reductions and proactively exploring new, emerging markets to cope with these evolving conditions. Looking forward to the upcoming peak season, we maintain a measured optimism that strategic planning and continued innovation will support long-term growth within the sector.”

Download the latest report of DTI (PDF version) (Text-only version).

Download of DTI Quarterly Report

Methodology

Index Calculation: Index = [100 x (Percentage of samples responding "Positive") ] + [50 x (Percentage of samples responding "Neutral") ] + [0 x (Percentage of samples responding "Negative") ]

Readings

- Ratios of collected responses are used to form the indices.

- An index value above 50 indicates an overall positive outlook while a reading below 50 represents an overall negative outlook for the surveyed quarter.

- The further the reading is from 50, the more positive or negative the outlook is.

Demographics

- Respondents are Hong Kong-based companies with either inbound or outbound air trade. It includes Watches, Clocks & Jewellery, Apparel & Clothing Accessories, Electronic Products & Parts, Gifts, Toys & Houseware, Food & Beverage and Others (including courier items and other items that do not belong to the categories listed above).

- Over 600 samples are collected in each quarter.

- Sample companies are randomly selected from publicly available directories.

Disclaimer

This report contains survey result based on research findings. HKPC will not be liable for any loss, mistake, delay, action or non-action by viewers of this report.

Enquiry

For more details about the Index, please contact HKPC at tel. (852) 2788 5306.

Share the latest information of HKPC to your inbox

LANGUAGE

LANGUAGE